In recent years, the adoption of solar energy has gained remarkable momentum as awareness of climate change deepens and energy prices fluctuate. Homeowners across the globe are increasingly looking to solar panels as a viable solution to reduce energy costs and contribute to a greener planet. One significant factor that has aided in this transition is the availability of tax rebates, which make solar energy systems more financially accessible. By understanding how these rebates work, homeowners can take full advantage of the benefits they offer.

Understanding Solar Tax Rebates

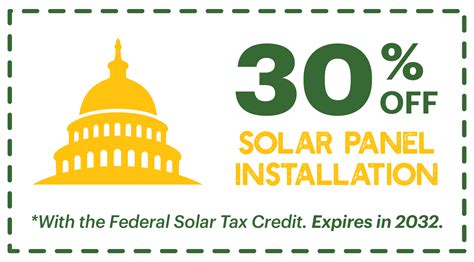

Solar tax rebates are financial incentives provided by federal, state, and sometimes local governments to reduce the installation costs for solar energy systems. They are designed to promote renewable energy usage and support homeowners in making the switch to cleaner energy sources. The most notable rebate in the United States is the federal Investment Tax Credit (ITC), which allows taxpayers to deduct a significant percentage of the cost of solar systems from their federal taxes.

The Federal Investment Tax Credit (ITC)

The ITC has been instrumental in driving the growth of the solar industry. Currently, the credit allows homeowners to claim a deduction of 26% on the total cost of solar panel installations. This means that if you install a solar energy system costing $20,000, for example, you could potentially reduce your tax liability by $5,200. This substantial tax incentive helps bridge the affordability gap, making it much easier for many families to invest in solar technology.

State and Local Incentives

In addition to the federal ITC, many states and local governments offer their own incentives, further enhancing the appeal of solar energy systems. These incentives can come in various forms, including cash rebates, property tax exemptions, and sales tax exemptions. For instance, states like California, New York, and Massachusetts have robust solar rebate programs that can significantly reduce upfront costs.

Financing Options

While tax rebates play a crucial role in making solar affordable, homeowners may also explore financing options. Many financial institutions now offer specific solar loans that can help homeowners pay for their solar energy systems without the burden of high upfront costs. When combined with tax rebates, these financing options enable more homeowners to consider investing in solar energy, as the immediate impact on cash flow is diminished.

Long-Term Savings

Switching to solar is not just about tax rebates; it’s also about long-term financial savings. Once installed, solar panels typically generate free electricity for 25 years or more. As electricity rates continue to rise, homeowners with solar energy systems find themselves increasingly insulated from fluctuating power prices. In many cases, the combination of tax rebates and the savings garnered from reduced energy bills results in a return on investment (ROI) that can be realized within a few short years.

Environmental Impact

Beyond the financial benefits, transitioning to solar energy presents significant environmental advantages. Homeowners adopting solar systems reduce their reliance on fossil fuels, which leads to a decrease in greenhouse gas emissions and other pollutants. By harnessing the sun’s energy, homeowners contribute to the fight against climate change and help foster a more sustainable future for generations to come.

What to Consider Before Installing Solar Panels

Before making the decision to install solar panels, homeowners should consider several key factors. These include the solar potential of their home, local regulations, and the specific options available for tax rebates and incentives. An assessment by a qualified solar contractor can provide crucial insights into how solar panels can best fit a homeowner’s needs and what financial incentives can be utilized.

Conclusion

In summary, tax rebates significantly lower the financial burden for homeowners considering solar energy systems. Programs like the federal ITC can make the transition to solar not only feasible but also financially attractive. With continuous advancements in technology, financing options, and incentives from both federal and local governments, solar energy is becoming increasingly accessible. The time to harness the sun has never been better, and making the switch can lead to substantial savings, energy independence, and a positive environmental impact.

FAQs

1. What is the federal Investment Tax Credit (ITC)?

The ITC is a federal tax incentive that allows homeowners to deduct a percentage of the cost of solar energy systems from their federal taxes. As of now, it offers a 26% deduction for systems installed in 2021 and 2022, which will gradually decrease in the following years.

2. Do all states offer solar tax rebates?

No, not all states provide solar tax rebates. However, many states offer their own incentives, which may include rebates, tax exemptions, or performance-based incentives. It’s essential to check your specific state’s programs to see what’s available.

3. How can I maximize my savings when going solar?

To maximize savings, consider utilizing available tax rebates, exploring financing options like solar loans, and analyzing your home’s solar potential through an expert assessment. Additionally, staying informed about local and federal incentives can help you capitalize on available savings.

4. Are there any long-term maintenance costs associated with solar panels?

While solar panels require minimal maintenance, homeowners should be aware of potential costs such as cleaning, inverter replacements, and periodic inspections to ensure optimal performance. However, many solar systems come with warranties that can cover some of these expenses.

5. Is solar energy beneficial for the environment?

Yes, solar energy is a clean and renewable source of power that greatly reduces reliance on fossil fuels, leading to decreased greenhouse gas emissions and pollution, contributing positively to the environment.

Download Tax Rebate For Solar