The Iowa Rent Rebate program is a crucial financial resource for eligible residents in the state. If you’re struggling to make ends meet due to rising rents and economic challenges, understanding how this program works and how to access support can make a significant difference. This article covers everything you need to know about the Iowa Rent Rebate, including important contact information and steps for accessing assistance.

What is the Iowa Rent Rebate Program?

The Iowa Rent Rebate program, also known as the Iowa Property Tax Credit, provides financial assistance to low-income renters by offering rebates on a portion of the rent they pay. The program aims to alleviate the financial burden faced by individuals and families with low to moderate incomes. Established to assist residents in maintaining stable housing, the rent rebate program can offer critical support to those who qualify.

Eligibility Requirements

To qualify for the Iowa Rent Rebate, applicants must meet certain criteria:

- Be a resident of Iowa.

- Have a gross income that does not exceed the specified threshold.

- Have paid rent for the dwelling for which the rebate is being claimed.

- Must have a valid Social Security number.

- Must be 18 years or older or meet specific conditions if under 18.

It’s important to verify the latest income limits and eligibility guidelines as they can vary year to year. Always consult the official Iowa Department of Revenue website for up-to-date information.

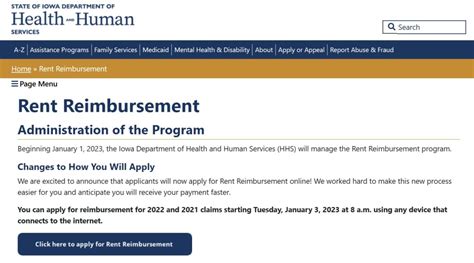

How to Apply for the Rent Rebate

The application process for the Iowa Rent Rebate is straightforward:

- Gather necessary documents: Collect required documents such as proof of income, rental agreement, and identification.

- Complete the application form: The form, known as the “Claim for Property Tax Credit” (Iowa Form 78-037), can be downloaded from the Iowa Department of Revenue website or obtained at local government offices.

- Submit your application: Applications can typically be submitted online or mailed to the appropriate county office. Make sure to follow the instructions on the application regarding deadlines.

Important Contact Information

For those looking to access assistance or provide inquiries, knowing the right phone numbers can save time and streamline your process. The primary contact points for the Iowa Rent Rebate include:

- Iowa Department of Revenue: (515) 281-3114

- Local County Treasurer’s Office: You can find the contact information for your local office on the Iowa Department of Revenue website.

Finding More Resources

If you need additional assistance beyond the Rent Rebate program, there are several resources available to Iowans:

- Community Action Agencies: These agencies provide a variety of services, including rent assistance and financial counseling.

- Iowa Housing Authority: Offers various housing-related resources and programs.

- Local Non-Profit Organizations: Many local charities and organizations run programs aimed at helping low-income families with housing expenses.

Conclusion

Navigating financial challenges related to housing can be daunting, but programs like the Iowa Rent Rebate can offer substantial help. If you meet the eligibility criteria, it’s worth taking the time to apply and secure financial assistance. Whether through the primary Rent Rebate program, local community resources, or other associated assistance options, help is available. Utilizing the right contacts and resources can ensure you receive the support you need to gain stability and peace of mind.

FAQs

1. How long does it take to receive the rent rebate after applying?

The processing time for the rent rebate can vary. Typically, it may take several weeks to a few months to process applications. Be sure to check your application status by contacting the Iowa Department of Revenue.

2. Can I apply if I’m on a fixed income?

Yes, individuals on a fixed income may qualify for the Iowa Rent Rebate, provided they meet the income limits and other eligibility requirements. Ensure to include all sources of income when applying.

3. What if I missed the application deadline?

If you missed the application deadline, you may need to wait until the next application period. It’s crucial to keep an eye on announcements from the Iowa Department of Revenue regarding future deadlines and to gather your documentation early to avoid missing out.

4. Is the rent rebate taxable?

The amount you receive from the Iowa Rent Rebate is not considered taxable income on your Iowa state tax return. However, it’s best to consult a tax professional for personalized advice.

5. Can I apply for the Rent Rebate program if I rent from a family member?

Yes, you can still qualify for the rent rebate even if renting from a family member, provided that you have a written rental agreement and meet the eligibility requirements.

Download Iowa Rent Rebate Phone Number