Everything You Need to Know About the 2025 Ambetter Rebate Check

The Ambetter Rebate Check for 2025 is a topic that has garnered significant attention among healthcare consumers, policy enthusiasts, and financial analysts alike. With the ongoing changes in the healthcare landscape, it’s essential to understand what these rebate checks entail, who qualifies for them, and how they can affect you financially. This article provides a comprehensive overview of what you need to know about the 2025 Ambetter Rebate Check.

What is the Ambetter Rebate Check?

The Ambetter Rebate Check is a financial return offered by Ambetter Health to its policyholders. This rebate is based on specific criteria related to the company’s insurance performance and the overall costs incurred in delivering healthcare services. Essentially, the rebate is designed to provide some relief to policyholders, reflecting Ambetter’s commitments to affordability and consumer satisfaction.

Who is Eligible?

Eligibility for the 2025 Ambetter Rebate Check primarily depends on whether you were enrolled in an Ambetter health plan during the specified period. Policyholders who had an active plan during the qualifying year are eligible for the rebate. It’s essential to verify your coverage details to ensure that you qualify. Additionally, the rebate amounts can vary based on different factors, including the type of plan and the overall claims incurred.

How Are Rebate Amounts Determined?

The determination of rebate amounts is influenced by several factors, including:

- Medical Loss Ratio (MLR): The MLR is a metric that indicates the percentage of premium revenue that an insurer spends on medical care and health services. If the MLR exceeds the federally mandated minimum standards, Ambetter must issue rebates.

- Plan Performance: The overall performance of the Ambetter plans will also play a role. If the plans were particularly successful and managed to keep costs lower than expected, policyholders might see more substantial rebates.

- Regulatory Compliance: Ambetter must adhere to various regulations set forth by the healthcare system. These regulations can influence rebate policies and amounts.

Expected Timeline for the 2025 Rebate Checks

The timeline for the issuance of the rebate checks is another crucial aspect to consider. Generally, Ambetter will begin processing rebates during the mid-year following the covered period. For 2025, you can expect to see updates regarding rebates in mid-2026. It’s advisable to keep an eye on announcements from Ambetter and check your account details on their official website for the most accurate information.

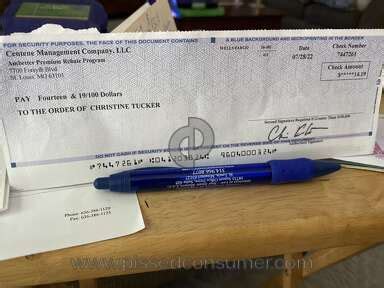

How Are the Checks Distributed?

Rebate checks are typically distributed via mail to the address on file for eligible policyholders. In some cases, where feasible, Ambetter may also offer digital payment options. It’s crucial to ensure that your contact information is up to date to receive your rebate promptly.

What Should You Do with Your Rebate Check?

Once you receive your rebate check, you have several options:

- Deposit the Check: The most straightforward option is to deposit the check into your bank account. This will provide immediate liquidity.

- Reinvest in Healthcare: Consider using the funds to pay for out-of-pocket medical expenses, wellness programs, or preventive healthcare services.

- Save for Future Healthcare Costs: Setting aside the money for future medical expenses can be a smart financial strategy, especially in uncertain economic conditions.

Tax Implications of the Rebate Check

It’s important to note that generally, rebate checks are not considered taxable income. However, it’s best to consult a tax professional to ensure compliance with tax laws and regulations relevant to your state and personal situation.

Potential Changes in Future Rebate Policies

As healthcare regulations evolve, so too may Ambetter’s rebate policies. Be aware that there could be changes based on federal or state laws that affect how and when rebates are issued. Keeping informed through credible sources about any potential updates can help you navigate these changes more effectively.

Conclusion

The 2025 Ambetter Rebate Check represents an opportunity for policyholders to benefit from their insurance plans. Understanding the eligibility criteria, the process of receiving rebates, and how best to utilize these funds is vital. By keeping informed and proactive about your Ambetter coverage, you can make the most out of your health insurance and possibly alleviate some of your financial burdens. Regularly check with Ambetter Health’s official communications to stay up to date on any changes regarding your rebate check.

FAQs

1. When will the 2025 Ambetter rebate checks be sent out?

The rebate checks are generally issued mid-year following the qualifying period, which means you can expect them in mid-2026 for the 2025 rebates.

2. How do I check if I am eligible for the rebate?

You can verify your eligibility by checking your account on the Ambetter Health website and reviewing your policy details for the relevant time period.

3. Are rebate checks considered taxable income?

Generally, rebate checks are not considered taxable income, but consulting a tax professional is advisable to understand your specific situation.

4. Can I receive my rebate check electronically?

While checks are typically distributed by mail, Ambetter may offer digital payment options. Check their announcements for more details.

5. What should I do if I don’t receive my rebate check?

If you believe you are eligible for a rebate but do not receive a check, contact Ambetter Customer Service for assistance.

Download Ambetter Rebate Check 2025