The Anchor Rebate Program in New Jersey is designed to provide financial relief to homeowners and tenants, helping to alleviate some of the burden from property taxes. With various components and eligibility criteria, navigating the Anchor Rebate Program can be complicated. This guide aims to clarify the details surrounding Anchor Rebate Status in NJ, including the application process, how to check your rebate status, and what to expect after applying.

What is the Anchor Rebate Program?

The Anchor Rebate Program was introduced in New Jersey to support eligible property owners and renters with a rebate on property taxes. This initiative is meant to ensure that housing remains affordable for residents by reducing the financial pressures of property tax payments.

Eligibility Criteria

To qualify for the Anchor Rebate, applicants must meet specific criteria:

- Homeowners: Must have been a resident of New Jersey and owned a home as of October 1 of the year for which they are applying.

- Tenants: Must have been renting a property in New Jersey as of October 1 and must provide proof of rent payments.

- Income Limits: There are income thresholds to ensure that the program supports those who need it most. Homeowners must have an income below a specified amount to qualify.

The Application Process

Applying for the Anchor Rebate is straightforward but requires careful attention to detail:

- Obtain the Application Form: You can find the application form on the New Jersey Division of Taxation’s website. Ensure you’re using the correct year’s form.

- Complete the Form: Fill in all required information, including income, property details, and tax identification numbers.

- Submit the Application: Applications can usually be submitted online, by mail, or in person. Ensure you keep a copy for your records.

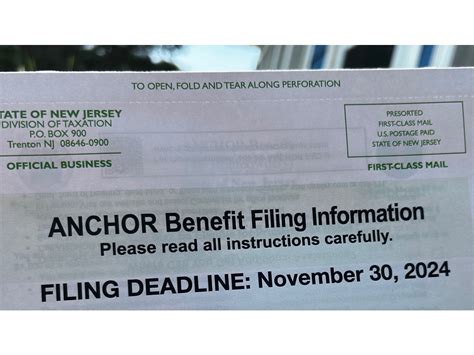

- Deadline: Applications typically need to be submitted by a specific date, often in early summer. Missing this deadline can result in losing the rebate for that year.

How to Check Your Anchor Rebate Status

After applying, many applicants want to know how to check their Anchor Rebate status. Here’s how you can do it:

- Visit the NJ Division of Taxation Website: This site has resources and tools to check your status.

- Provide Required Information: You will need to enter pertinent details such as your Social Security number and other identification info to retrieve your status.

- Contact Customer Service: If you’re having trouble online, consider reaching out to the customer service department for assistance.

What to Expect After Applying

Once your application is submitted, the processing time can vary:

- Notification: You will receive a notification regarding the status of your application. This could be via mail or email, depending on how you submitted your application.

- Rebate Amount: The amount you receive will depend on your eligibility and the value of the home. Homeowners generally receive a larger rebate compared to tenants.

- Timeline: Rebates can take several weeks to process, so it’s essential to be patient while waiting for your check or direct deposit.

Common Issues and Troubleshooting

While most applications go smoothly, some issues may arise:

- Incorrect Information: Ensure all your information is accurate on the application to avoid delays.

- Missing Documentation: Make sure to include all necessary documents to support your application.

- Technological Issues: If you encounter difficulty using the online system, don’t hesitate to contact support for help.

Conclusion

The Anchor Rebate Program serves as a crucial financial support mechanism for New Jersey residents facing high property taxes. By understanding the eligibility, application process, and how to check your rebate status, residents can make informed decisions and ensure they receive the benefits they deserve. It’s vital to stay informed of deadlines and requirements each year to maximize your potential rebate.

FAQs

1. How much can I expect as a rebate?

The rebate amount varies based on your income, housing type, and other factors. It’s calculated according to state-set thresholds for homeowners and tenants.

2. Is there a deadline for applying for the Anchor Rebate?

Yes, applications typically need to be submitted by a specific date, which is announced each year. It is generally in early summer.

3. Can I check my application status online?

Absolutely! You can check your status on the New Jersey Division of Taxation’s website by providing your personal details.

4. What should I do if my application is denied?

If your application is denied, the notice will outline the reasons. You can appeal the decision by following the instructions provided in the notification.

5. Where can I get assistance with the application?

You can contact the New Jersey Division of Taxation or visit their website for detailed assistance and resources regarding application help.

Download Anchor Rebate Status Nj