The automotive industry is undergoing a significant transformation, with electric vehicles (EVs) leading the charge toward a more sustainable future. As the demand for EVs increases, governments around the world are introducing tax rebates and incentives to encourage consumers to make the switch from gasoline-powered vehicles. In this article, we’ll explore the latest tax rebates available for electric vehicle buyers, how they work, and what potential buyers need to know.

What Are Electric Vehicle Tax Rebates?

Electric vehicle tax rebates are financial incentives offered by the government to encourage consumers to purchase EVs. These rebates help offset the higher upfront costs associated with electric vehicles, making them more accessible to a broader range of consumers. Tax rebates can vary significantly depending on the country or region and may include federal, state, or local incentives.

How Tax Rebates Work

Tax rebates for electric vehicles generally work by reducing the total amount of income tax you owe. For instance, if you buy an electric vehicle and qualify for a rebate of $7,500, you can deduct that amount from your overall tax bill. It’s essential to note that tax rebates may not be refundable, meaning they will only reduce your tax liability to zero but won’t provide you with cash back if the rebate exceeds the amount you owe.

Latest Federal Tax Rebates in the United States

As of 2023, the U.S. federal government offers a tax credit of up to $7,500 for qualifying electric vehicles under the Inflation Reduction Act. However, the eligibility for this credit depends on several factors:

- Manufacturing Cap: The EV must be manufactured by a company that meets certain criteria, which may include sourcing materials from specific locations.

- Battery Capacity: To qualify for the full $7,500 credit, the vehicle must have a battery with a minimum capacity.

- Income Limitations: Buyers with an adjusted gross income above certain thresholds may not qualify for the federal tax credit.

State-Specific Incentives

In addition to federal credits, many states offer their own rebates and incentives to encourage electric vehicle adoption. For example:

- California: Offers additional rebates ranging from $2,000 to $7,000 based on income.

- New York: Offers a rebate of up to $2,000 for electric vehicles, along with additional incentives for low-income buyers.

- Texas: Offers a $2,500 rebate for certain electric vehicles.

It is crucial for prospective buyers to check the specific incentives available in their state, as these can significantly reduce the cost of an EV.

Additional Financial Incentives

Beyond tax rebates, there are several other financial incentives that can help make electric vehicle ownership more affordable:

- Local Utility Rebates: Many local utility companies offer rebates for EV purchases or provide incentives for installing home charging stations.

- HOV Lane Access: Some states grant electric vehicles access to high-occupancy vehicle (HOV) lanes, which can save time and make commuting more efficient.

- Reduced Registration Fees: Certain states may offer reduced registration fees for electric vehicles compared to their gasoline counterparts.

How to Claim Your Tax Rebate

To claim your electric vehicle tax rebate, you’ll typically need to complete IRS Form 8834 when filing your federal income tax return. It’s also vital to maintain records that demonstrate your vehicle’s eligibility for the rebate, including:

- Proof of purchase

- Vehicle identification number (VIN)

- Documentation from the manufacturer

Consulting with a tax professional can also help ensure that you correctly navigate the rebate process.

Challenges and Considerations

While tax rebates and incentives make electric vehicles more affordable, potential buyers should keep several challenges in mind:

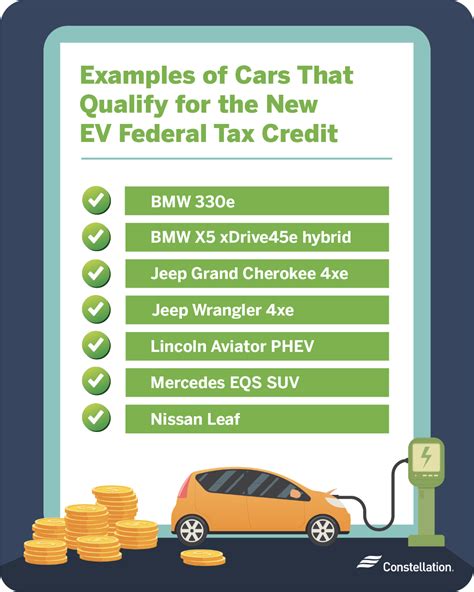

- Availability: Not all electric vehicles qualify for the rebates. Always check eligibility before proceeding with a purchase.

- Income Restrictions: Some incentives phase out for higher-income earners, limiting their availability.

- Market Fluctuations: The electric vehicle market is continually changing, which can affect the availability of models and pricing.

Conclusion

As electric vehicles continue to gain popularity, understanding the tax rebates and incentives available can significantly impact the affordability of an EV. With federal and state-level programs designed to encourage greener transportation, potential buyers have a variety of options to save money on their transition to electric vehicles. Through tax credits, state incentives, and additional perks, driving green is becoming not only an environmentally responsible choice but also a financially savvy one.

FAQs

1. How do I know if my electric vehicle qualifies for a tax rebate?

Check the manufacturer’s information and look for any announcements regarding eligibility criteria related to the tax rebate. You can also consult with a tax professional.

2. Can I receive both state and federal rebates?

Yes, many buyers qualify for both federal tax credits and state-specific rebates, significantly enhancing savings.

3. What should I do if I don’t owe any taxes? Can I still claim a rebate?

Federal tax credits are non-refundable, meaning if you owe less than the credit amount, you can only reduce your tax liability to zero but won’t receive a refund for the difference.

4. Are there any loans or financing options available specifically for electric vehicles?

Yes, many financial institutions offer loans and financing specifically tailored for electric vehicles, sometimes with lower interest rates or favorable terms.

5. What is the best way to stay updated on changing incentives?

Frequently check the official government websites or sign up for newsletters from environmental organizations that track EV incentives, as these programs can change frequently.

Download Tax Rebate For Electric Cars