Driving Green: A Comprehensive Guide to State-Specific Electric Car Rebates

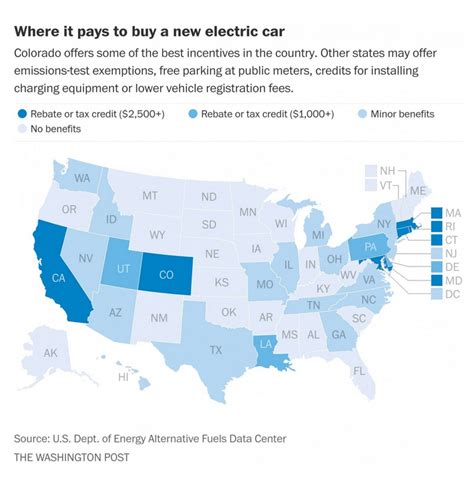

As the automotive industry shifts toward sustainability, electric vehicles (EVs) are gaining popularity among consumers. Governments recognize the environmental benefits of EVs and offer various incentives to encourage adoption. One of the most advantageous incentives is electric car rebates, which can significantly reduce the overall cost of purchasing an EV. This article explores state-specific electric car rebates in the United States, helping you navigate your way to a greener vehicle.

Understanding Electric Car Rebates

Electric car rebates come in various forms—direct cash rebates, tax credits, and reduced registration fees, among others. These incentives are designed to make electric vehicle ownership more affordable, promoting a reduction in greenhouse gas emissions and reliance on fossil fuels. However, the specific details can vary considerably from state to state, ranging from hundreds to thousands of dollars in savings.

State-Specific Electric Car Rebates

California

California leads the nation in electric vehicle adoption, providing significant incentives to encourage this transition. The California Clean Vehicle Rebate Project (CVRP) offers rebates ranging from $2,000 to $7,000, depending on income and vehicle eligibility. Additionally, residents may qualify for federal tax credits up to $7,500, making the overall savings on an EV considerable. If you live in a disadvantaged community, additional incentives may also be available.

New York

In New York, the Drive Clean rebate program offers incentives of up to $2,000 for electric vehicles. Along with the federal tax credit, these rebates can substantially lessen the financial burden of going electric. New York also supports EV infrastructure development, promoting a more extensive network of charging stations statewide.

Texas

Texas has a unique offering known as the Texas Electric Vehicle Incentive Program (TEVIP), which provides rebates of up to $2,500 for eligible electric vehicle purchases. Additionally, some local utility companies may provide further incentives or rebates to residential customers who install EV charging equipment.

Florida

Florida offers a rebate program through the Florida Department of Environmental Protection, though the amount fluctuates based on the funding available. Incentives can be as much as $5,000 for qualifying electric vehicles. Moreover, Florida offers tax credits and other incentives for charging station installations, enhancing the appeal for EV buyers.

Washington

Washington State has implemented the Electric Vehicle Rebate program, offering up to $3,000 for qualifying EV purchases. The state’s sales tax exemption on electric vehicle purchases in certain areas further adds to the attractiveness of owning an EV.

Oregon

Oregon’s EV rebate program offers up to $2,500 for new electric vehicles. In addition, residents can take advantage of the federal tax credit and state-level incentives for home charging stations, making it easier for consumers to switch to electric.

How to Apply for Electric Car Rebates

Applying for electric car rebates typically requires consumers to follow a straightforward process:

- Research Eligibility: Check the eligibility criteria for the state rebate and ensure the vehicle qualifies.

- Purchase the Vehicle: Buy or lease your electric vehicle from an authorized dealer.

- Gather Documentation: Collect necessary documents, which often include proof of purchase, vehicle registration, and applicable identification.

- Submit Application: Complete and submit the application form, either online or by mail, as per your state’s instructions.

- Receive Rebate: Once approved, the rebate amount will be processed and sent to you, either as a check or a direct deposit.

Conclusion

Driving an electric vehicle not only contributes to a cleaner environment but also allows you to take advantage of various state-specific rebates that can significantly cut the cost of ownership. Each state offers its tailored programs, and it’s crucial to stay informed about the incentives you may qualify for. By researching your state’s electric car rebates, you can make an informed decision regarding your shift to sustainable driving. Always consider consulting with local dealerships and state government resources for the most accurate information regarding current incentives.

FAQs

1. How much can I save with electric car rebates?

The savings from electric car rebates can range from a few hundred to several thousand dollars depending on your state and vehicle eligibility. Combine state-specific rebates with federal tax credits for maximum savings.

2. Are all electric vehicles eligible for rebates?

Not all electric vehicles qualify for rebates. Each state has specific rules regarding eligible models, so it’s essential to check your local program guidelines to see if your vehicle qualifies.

3. Can I get both state and federal rebates?

Yes, you can often receive both state and federal incentives, maximizing your savings when purchasing an electric vehicle. Always verify the eligibility conditions and amounts with state and federal guidelines.

4. Are there rebates for used electric vehicles?

Some states offer rebates for used electric vehicles, but these programs are less common than those for new vehicles. Be sure to check your state’s policies to see what options are available.

5. How long does it take to receive my rebate?

The time it takes to receive your rebate varies by state, but generally, it can take a few weeks to a few months. Be sure to check the processing times provided by your specific program.

Download Electric Car Rebates By State