Driving Down Costs: Understanding the New Electric Car Tax Rebate

As electric vehicles (EVs) become more mainstream, the government has taken steps to promote their adoption through various incentives. One of the most significant incentives is the electric car tax rebate, which aims to make the transition to electric vehicles more financially viable for the average consumer. This article provides an overview of the new electric car tax rebate, explaining its purpose, eligibility requirements, and how it can help you save money on your next vehicle purchase.

What is the Electric Car Tax Rebate?

The electric car tax rebate, often referred to as a tax credit, is a financial incentive provided by the government to encourage the purchase of electric and plug-in hybrid vehicles. This rebate usually takes the form of a reduction in the federal income tax owed, which can significantly reduce the effective cost of purchasing an EV.

In recent years, various administrations have adjusted the rebate amounts and eligibility criteria in an effort to promote environmental sustainability and reduce greenhouse gas emissions.

Eligibility Requirements

To benefit from the electric car tax rebate, buyers must meet several eligibility criteria. Understanding these requirements is crucial for those considering an electric vehicle purchase:

- Purchase Date: The vehicle must be purchased within a specific time frame set by the government to qualify for the rebate. Always check the latest guidelines to ensure your purchase qualifies.

- Vehicle Type: The tax credit typically applies to new electric vehicles and certain plug-in hybrid electric vehicles (PHEVs). It does not generally extend to used cars.

- Manufacturer Sales Cap: There may be a cap on the total number of vehicles that a manufacturer can sell before the tax credit is phased out. Make sure your chosen vehicle is still eligible before making a purchase.

- Income Limits: Some rebates may have income limits that dictate eligibility based on your modified adjusted gross income (MAGI).

Tax Credit Amounts

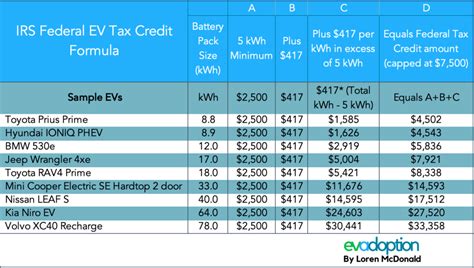

The amount of the electric car tax rebate can vary based on several factors, including the type of vehicle and its battery capacity. As of the latest updates, here are a few points to note:

- Standard Credit: The federal tax credit can be as much as $7,500 for qualifying electric vehicles, depending on their battery size.

- State Incentives: Many states offer additional rebates or tax credits on top of the federal incentive, which can increase potential savings even further.

- Phased-Out Amounts: As manufacturers reach production milestones (e.g., selling over 200,000 electric vehicles), the amount of the rebate may be gradually reduced before being discontinued altogether.

How to Claim the Electric Car Tax Rebate

Claiming the electric car tax rebate is relatively straightforward, but it does require some paperwork. Here’s a breakdown of the process:

- Document Your Purchase: Keep all paperwork related to the purchase of your electric vehicle. This includes the purchase contract, invoice, and information about the vehicle.

- Complete IRS Form 8834: This form allows you to claim the qualified electric vehicle credit. You’ll need to include specific vehicle details and the amount you paid for the vehicle.

- File Your Tax Return: Attach Form 8834 to your federal tax return for the year in which you purchased the vehicle. Be sure to consult with a tax professional if needed.

- State and Local Credits: Don’t forget to research and apply for any additional state or local credits available to you, as many areas have their own programs aimed at promoting electric vehicle adoption.

Benefits of Driving an Electric Vehicle

In addition to the upfront savings provided by the electric car tax rebate, there are numerous long-term benefits associated with owning an electric vehicle:

- Lower Operating Costs: EVs typically have lower fueling costs compared to gasoline vehicles. Electricity is generally cheaper than gasoline, and many EV owners find they spend significantly less on routine maintenance.

- Environmental Benefits: By driving an electric vehicle, you are reducing your carbon footprint and supporting a cleaner environment, which is a compelling reason to make the switch.

- Quiet and Smooth Operation: Electric vehicles offer a quieter and smoother ride compared to traditional combustion-engine vehicles.

Conclusion

The new electric car tax rebate is a valuable incentive for consumers looking to make an environmentally friendly switch to electric vehicles. By understanding the rebate’s eligibility requirements, tax amounts, and claiming process, you can take full advantage of this opportunity to save money on your next car purchase. As electric vehicles continue to grow in popularity and affordability, now is an excellent time to consider making the switch.

FAQs

1. How do I know if my vehicle qualifies for the electric car tax rebate?

You can check the IRS website or consult with your tax professional to determine if your vehicle meets the eligibility criteria for the tax credit.

2. Can I still receive the rebate if I purchase a used electric vehicle?

No, the federal electric car tax rebate typically applies only to new electric vehicles and certain plug-in hybrids. Be sure to check for any state incentives that may apply to used vehicles.

3. How does the phased-out credit work?

Once a manufacturer sells over 200,000 electric vehicles, the tax credit begins to phase out. You can still receive partial credits for a limited time, but the amount decreases over the subsequent quarters until it is no longer available.

4. Are there state-specific rebates available in addition to the federal credit?

Yes, many states offer their own tax credits or rebates for electric vehicle purchases. Check your local state government’s resources for more information.

5. Can I combine the federal rebate with other incentives?

Yes, in most cases you can combine the federal tax rebate with state or local incentives, significantly increasing your total savings.

Download Electric Car Tax Rebate