Driving Change: Your Guide to California’s Electric Vehicle Rebates

As the world shifts toward sustainable energy solutions, California is leading the way with its ambitious goals to reduce greenhouse gas emissions. A significant part of this initiative is the promotion of electric vehicles (EVs). To encourage residents to make the switch to cleaner transportation options, the state offers a variety of rebates and incentives for electric vehicle purchases. In this article, we will explore the different rebate programs available, eligibility criteria, and steps to apply, empowering you with the knowledge to embrace this eco-friendly change.

Understanding California’s Electric Vehicle Rebates

California offers numerous financial incentives aimed at reducing the cost of electric vehicle ownership. These rebates are a part of the state’s larger framework for promoting renewable energy and reducing pollution. The primary rebate program is the California Clean Vehicle Rebate Project (CVRP), which provides cash rebates to individuals and businesses that purchase or lease eligible zero-emission vehicles.

Types of Rebates Available

California Clean Vehicle Rebate Project (CVRP)

Under the CVRP, consumers can receive rebates of up to $7,000 for the purchase or lease of eligible vehicles. The exact amount depends on the type of vehicle and the buyer’s income level. For example, low- to moderate-income residents may qualify for additional rebates, making electric vehicles even more accessible.

Federal EV Tax Credit

In addition to state rebates, the federal government also offers an electric vehicle tax credit that can significantly reduce the cost of purchasing an EV. The tax credit can be up to $7,500, depending on the vehicle’s battery capacity. Note that this credit is typically applied at tax time.

Utility Company Rebates

Many utility companies in California also provide additional incentives or rebates for electric vehicle owners. These can include discounts on installation for home charging stations, lower rates for charging during off-peak hours, and bonuses for signing up for special EV programs. Check with your local utility provider to learn more about these opportunities.

Eligibility Criteria

To qualify for the various rebate programs, applicants must meet specific eligibility requirements. Here are the general criteria for the California Clean Vehicle Rebate Project:

- Applicants must be California residents.

- The vehicle must be a new, eligible zero-emission vehicle.

- Applicants must meet income requirements, especially for additional rebate amounts.

- Rebates are available on a first-come, first-served basis until funds are exhausted.

How to Apply for Rebates

Applying for California’s electric vehicle rebates is a straightforward process. Here’s how to do it:

- Purchase or Lease an Electric Vehicle: Start by buying or leasing a new eligible electric vehicle from a dealership. Make sure to confirm the vehicle’s eligibility for rebates.

- Gather Necessary Documents: Collect required documents, including proof of California residency, vehicle purchase or lease agreement, and income documentation if applicable.

- Submit Your Application: Complete the online application form for the CVRP through the California Air Resources Board (CARB) website. Ensure that all required documents are uploaded.

- Receive Your Rebate: After processing your application, you’ll receive your rebate check in the mail if you are approved.

Additional Considerations

While the financial incentives can significantly offset the cost of electric vehicles, there are several other factors to consider:

- Charging Infrastructure: Evaluate the availability of charging stations in your area. Home charging installations can also be incentivized through utility programs.

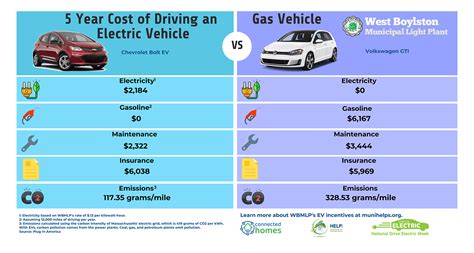

- Maintenance Costs: Electric vehicles generally have lower maintenance costs compared to traditional vehicles, contributing to long-term savings.

- Environmental Impact: Transitioning to an electric vehicle not only reduces your personal carbon footprint but also supports California’s environmental goals.

Conclusion

California’s electric vehicle rebate programs provide a robust incentive for residents to transition toward sustainable transportation. By leveraging these rebates, you can significantly reduce the upfront cost of purchasing an electric vehicle while contributing to a greener future. As you consider making the switch, take the time to explore the available options and understand the eligibility criteria. With the state’s support, driving change through electric vehicles is not just a possibility—it’s an exciting reality.

FAQs

1. How much can I get from the CVRP?

The California Clean Vehicle Rebate Project offers rebates up to $7,000 based on the type of vehicle and income level.

2. Are there federal incentives available for electric vehicles?

Yes, the federal government provides an electric vehicle tax credit that can be up to $7,500 depending on the vehicle’s battery capacity.

3. How do I check if my vehicle is eligible for rebates?

You can visit the California Air Resources Board website, where they provide a list of eligible vehicles.

4. Can I receive multiple rebates for the same vehicle?

Typically, you cannot stack multiple rebates for the same vehicle; however, you can use state and federal incentives together.

5. What if I have further questions about the application process?

If you have questions, you can contact the California Air Resources Board or your local utility company for support.

Download Rebates For Electric Vehicles California