The transition to electric vehicles (EVs) is not just a trend; it’s a crucial step towards a sustainable future. In the United States, the recent introduction of federal rebates for EVs aims to accelerate this transition. Understanding the intricacies of these new policies can help consumers make informed decisions while contributing to environmental sustainability.

The Importance of Electric Vehicles

Electric vehicles offer numerous benefits compared to traditional gasoline-powered cars. They produce zero tailpipe emissions, which significantly reduces air pollution and greenhouse gas emissions. Additionally, EVs boast lower operating costs, with lower fuel and maintenance expenses. As more consumers recognize these advantages, the demand for electric vehicles continues to climb.

Overview of the New Federal Rebate

The new federal rebate program, implemented as part of the Inflation Reduction Act, aims to make EVs more accessible for consumers. The program provides a tax credit of up to $7,500 for the purchase of qualified electric vehicles. This financial incentive is designed to encourage more consumers to transition away from gasoline vehicles.

Eligibility Criteria

To qualify for the federal rebate, several criteria must be met:

- Vehicle Requirements: EVs must meet specific requirements; they should be new, purchased from a dealer, and fall within the price limits of $55,000 for cars and $80,000 for SUVs and trucks.

- Manufacturer Sales Cap: The rebate is available for EVs from manufacturers that have sold fewer than 200,000 qualifying vehicles, a provision aimed at benefiting newer companies in the EV market.

- Income Limits: There are income thresholds for eligibility. For single filers, the limit is set at $150,000, while joint filers can qualify if they earn less than $300,000.

Applying for the Rebate

To apply for the rebate, consumers must complete IRS Form 8834 when filing their federal tax return. It is essential to keep records of the purchase and any relevant documentation to support the claim. The process may seem complex, but there are numerous resources available to assist in navigating it.

Environmental Impact and Future Prospects

The implementation of federal rebates for electric vehicles is expected to have a significant impact on reducing greenhouse gas emissions. As consumers shift towards electric alternatives, the cumulative effect can lead to substantial improvements in air quality and a reduction in the reliance on fossil fuels. Furthermore, as the technology behind electric vehicles advances, we can anticipate added benefits such as longer driving ranges, faster charging times, and improved battery efficiency.

Challenges in Adoption

While the federal rebate is a significant step forward, several challenges remain in the widespread adoption of electric vehicles. One major hurdle is the lack of charging infrastructure, especially in rural areas. Consumers are often concerned about the availability of charging stations, which can hinder their willingness to switch from traditional vehicles.

Additionally, the initial purchase price of electric vehicles can still be a barrier despite the rebate. For many consumers, the upfront cost may still be out of reach, suggesting that further financial incentives or support could accelerate adoption.

Conclusion

The new federal rebate for electric vehicles is a significant move towards a greener economy and reflects a growing recognition of the importance of sustainability in our transportation systems. By understanding the eligibility criteria and application process, consumers can take advantage of this opportunity to make a positive environmental impact. As infrastructure improves and EV technology continues to advance, the future looks bright for electric vehicles and the role they will play in our collective transition to a more sustainable world.

FAQs

1. How do I know if my vehicle qualifies for the federal rebate?

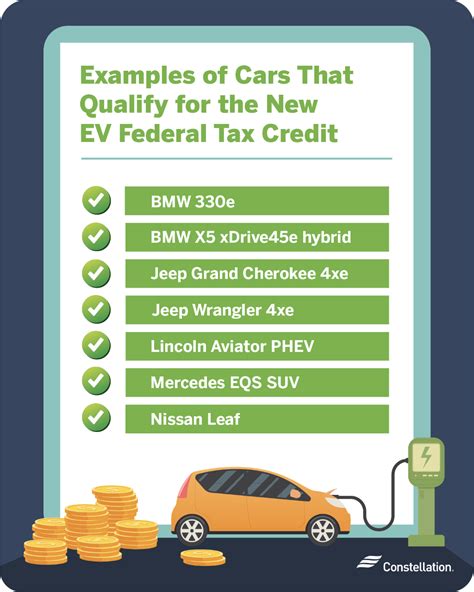

Check the manufacturer’s specifications and confirm whether it meets the outlined criteria, including sales cap and price limits. The IRS also provides a list of qualifying vehicles.

2. Can I get the rebate if I lease an electric vehicle?

Yes, leasing consumers can also benefit from the tax credit, depending on the terms negotiated with the leasing company. It’s advisable to verify how the rebate affects your specific lease agreement.

3. Is there a limit to how many times I can claim the rebate?

There is no set limit on the number of times you can claim the rebate, but each vehicle purchased must be eligible and meet all criteria. Be aware that claiming the rebate multiple times for the same vehicle is not permitted.

4. What if I live in a state with additional EV incentives?

Many states offer additional incentives, which can be stacked on top of the federal rebate. Check with your state’s transportation agency for details on what is available in your area.

5. How does the tax credit affect my overall tax liability?

The tax credit directly reduces your tax liability dollar for dollar. For example, if you owe $5,000 in taxes and qualify for a $7,500 credit, your tax liability would be reduced to zero, with the remaining credit potentially carried forward to the next tax year, depending on specific regulations.

Download Federal Rebate On Electric Cars