As the world shifts towards sustainability, electric vehicles (EVs) have become a popular choice for environmentally conscious consumers. Not only do they reduce carbon footprints, but they also offer significant financial incentives. One of the most appealing aspects of investing in an electric vehicle is the tax rebates available to consumers. In this article, we will delve into the details of electric car tax rebates, how they can benefit you, and what you need to know to take full advantage of these savings opportunities.

Understanding Electric Car Tax Rebates

Tax rebates for electric cars are government incentives designed to promote the adoption of eco-friendly vehicles. These rebates can significantly reduce the purchase price of an electric vehicle, making them more accessible to a broader audience. Various federal, state, and even local governments offer these rebates to encourage people to switch from traditional gas-powered vehicles to electric alternatives.

Types of Rebates

There are typically two types of tax incentives available for electric vehicle buyers:

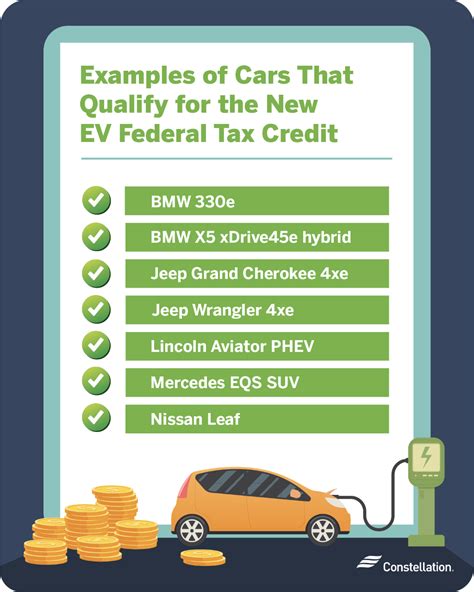

- Federal Tax Credit: In the United States, eligible buyers can receive a federal tax credit of up to $7,500. The exact amount may vary based on the vehicle’s battery capacity and the manufacturer’s sales. It’s essential to note that this tax credit applies to the buyer, not the vehicle, meaning you can benefit from it regardless of the car’s resale value.

- State and Local Rebates: Many states offer additional incentives, which can range from rebates and grants to tax credits. Some municipalities have local programs that provide further financial assistance. For example, California offers up to $2,500 in state rebates for eligible EV buyers, while other states may offer incentives that vary based on local tax laws.

Why You Should Consider Buying an Electric Vehicle

Besides the financial benefits, transitioning to an electric vehicle comes with numerous advantages:

- Environmental Impact: Electric vehicles produce zero tailpipe emissions, significantly reducing air pollution. By driving an EV, you contribute to a cleaner planet.

- Fuel Savings: Charging a vehicle is generally cheaper than filling a gas tank. The cost per mile for electric vehicles is significantly lower compared to gasoline-powered cars.

- Maintenance Costs: EVs have fewer moving parts and require less maintenance, leading to lower long-term costs. There is no need for oil changes, and brake wear is reduced due to regenerative braking systems.

- Tax Rebates: As mentioned, the tax rebates significantly reduce the upfront cost of purchasing an electric vehicle, making it a financially viable option for many consumers.

How to Claim Your Electric Car Tax Rebate

Claiming your electric vehicle tax rebate can be straightforward if you follow the right steps:

- Research Eligibility: Before you make your purchase, ensure the vehicle qualifies for the federal tax credit. The IRS website lists eligible models and their respective credits.

- Maintain Documentation: When you purchase your electric vehicle, keep all relevant documentation, including the purchase agreement and any receipts for charging equipment—if applicable.

- File Your Taxes: When you file your federal tax return, complete IRS Form 8834 (Qualified Plug-in Electric Drive Motor Vehicle Credit). You may also need to check your state’s specific requirements to claim additional local incentives.

Conclusion

In conclusion, purchasing an electric vehicle can be a game-changer for both your wallet and the environment. The tax rebates and incentives offered by the federal government, as well as state and local initiatives, make the transition to electric vehicles more appealing than ever. With savings on both purchase price and long-term fuel and maintenance costs, investing in an electric car not only contributes positively to the environment but also enhances your financial well-being. As more people make the switch, the benefits of tax rebates and environmental impact will continue to grow, paving the way for a sustainable future.

FAQs

1. Who is eligible for the electric vehicle tax credit?

To qualify for the federal tax credit, the vehicle must meet specific criteria, such as being purchased new, having a battery capacity of at least 4 kilowatt-hours, and being used primarily in the U.S. Additionally, there are limits on the number of vehicles sold by each manufacturer; once a threshold is reached, the incentive may be phased out.

2. How do I know if my vehicle qualifies for the tax rebate?

You can check the IRS website for a list of eligible electric vehicles and their respective tax credits. It’s essential to verify the latest information before making a purchase.

3. Can I receive both federal and state incentives?

Yes, it is possible to receive both federal and state tax rebates, provided that you meet the eligibility requirements for each. Make sure to account for all rebates when calculating your total savings!

4. Do I have to pay back the tax credit?

Generally, the tax credit does not need to be repaid, as it is an incentive designed to bolster the purchase of electric vehicles. However, if you sell the car within a certain timeframe, you could be subject to provisions in your specific state or local regulations.

5. Are there any restrictions on where I can charge my electric vehicle?

While most EVs can be charged at home, public charging infrastructure is expanding rapidly. Always check compatibility with charging stations in your area to ensure you have convenient options available.

This HTML code provides a comprehensive article on electric car tax rebates, structured in Markdown format suitable for a WordPress post. It includes relevant sections, a conclusion, and a FAQs section.

Download Tax Rebate For Electric Car