Boosting Green Choices: Understanding the Federal Tax Rebate for Hybrid Vehicles

As environmental concerns become increasingly pressing, many individuals and families are making the shift towards greener alternatives in their transportation choices. One of the most significant advancements in eco-friendly commuting is the hybrid vehicle. Not only do these vehicles help reduce carbon emissions, but they also come with financial incentives that make them more accessible. Among these incentives is the Federal Tax Rebate for hybrid vehicles, a program designed to encourage more sustainable driving habits. In this article, we will delve into the details of the federal tax rebate for hybrid vehicles, how it works, and why it is an essential component in boosting green choices.

What is a Hybrid Vehicle?

Hybrid vehicles are those that use two or more types of power, typically an internal combustion engine paired with an electric motor. This combination enhances fuel efficiency and reduces emissions significantly compared to conventional gasoline-powered vehicles. Popular hybrid models include the Toyota Prius, Honda Insight, and Ford Fusion Hybrid. Understanding the mechanics of hybrid vehicles is essential before considering the available financial incentives.

The Federal Tax Rebate Explained

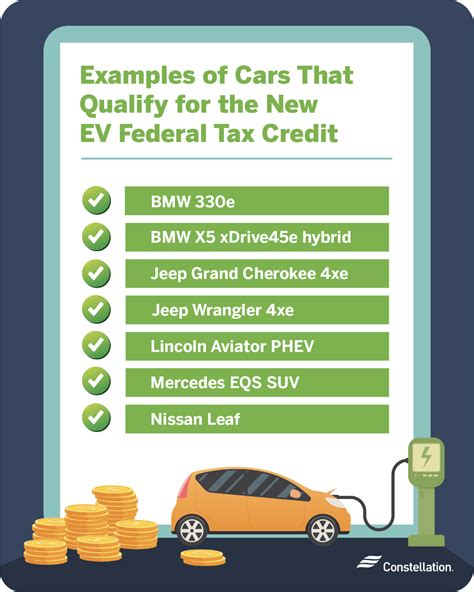

The Federal Tax Rebate for hybrid vehicles, often referred to as the Hybrid Vehicle Tax Credit, is a financial incentive offered by the U.S. government. This credit provides a deduction on federal taxes owed, essentially reimbursing vehicle owners for part of the cost of their hybrid vehicles. To qualify, the vehicle must meet specific criteria and be purchased from eligible manufacturers.

Eligibility Criteria

To qualify for the federal tax rebate, hybrid vehicles must satisfy the following criteria:

- The vehicle must be purchased new, not used.

- It must meet the minimum fuel efficiency standards set by the EPA.

- The vehicle must be manufactured after a specific date, as defined by the IRS.

- The tax credit diminishes over time as manufacturers reach sales milestones, typically after 200,000 units sold.

The Amount of the Rebate

The amount of the federal tax rebate for hybrid vehicles can vary based on several factors, including the specific model and its efficiency ratings. Generally, the tax credit can range from $2,500 to $7,500. The exact amount is determined by the vehicle’s battery capacity and emission ratings, with fully electric plug-in hybrids often qualifying for the higher end of the scale.

Claiming the Tax Rebate

Claiming the federal tax rebate for your hybrid vehicle is a straightforward process. When you file your federal income tax return, you will need to complete IRS Form 8834, the Qualified Plug-in Electric and Electric Vehicle Credit form. Here are some steps to guide you through claiming the credit:

- Secure all necessary documents from your car dealer that confirm your vehicle’s eligibility.

- Complete Form 8834, noting the specific details of your hybrid vehicle.

- Submit the completed form along with your tax return to the IRS.

- Consult a tax professional if you need assistance or clarification on the process.

Environmental Impact and Economic Benefits

Transitioning to hybrid vehicles offers both environmental and economic advantages. Regular use of hybrid vehicles can significantly reduce greenhouse gas emissions and contribute to a decrease in air pollution. For instance, the U.S. Environmental Protection Agency (EPA) estimates that hybrid vehicles can reduce greenhouse gas emissions by 25-35% when compared to traditional gas vehicles.

Economically, the tax rebate serves as an incentive to make a more considerable initial investment in hybrid vehicles. With the rising prices of gasoline, the savings on fuel costs can be substantial. Furthermore, many states offer additional rebates or incentives for hybrid vehicle owners, amplifying the overall financial benefits.

Challenges and Considerations

While the federal tax rebate is an excellent incentive, there are challenges and considerations that prospective hybrid vehicle owners should keep in mind. The diminishing credit can affect long-term savings, and not all hybrid models offer the same benefits. It’s crucial to do thorough research on the specific vehicle models to ensure that you are making an informed decision.

Conclusion

The federal tax rebate for hybrid vehicles is a vital component in boosting green transportation choices. By understanding its implications and benefits, consumers can make informed decisions that not only contribute to a more sustainable environment but also result in significant financial savings. With the growing emphasis on reducing carbon footprints and the increased availability of hybrid and electric vehicles, now is an ideal time to consider making the switch to greener alternatives.

FAQs

1. How do I know if my hybrid vehicle qualifies for the tax rebate?

You can check the IRS website for a list of eligible models or consult with your dealership. Additionally, Form 8834 will guide you through the eligibility requirements.

2. Can I receive the rebate if I purchased my vehicle used?

No, the federal tax rebate is only applicable to new hybrid vehicle purchases.

3. How does the rebate affect my overall tax situation?

The rebate reduces your taxable income, which can lower the amount of taxes you owe for the year. It’s advisable to consult a tax professional for specific advice tailored to your situation.

4. Are there state-level rebates available for hybrid vehicles?

Yes, many states offer additional incentives that can further reduce the cost of hybrid vehicles. It’s essential to research your state’s specific programs.

5. What happens if the tax credit decreases or is phased out?

The tax credit is subject to changes based on sales numbers and government regulations, so it’s crucial to stay informed about potential shifts in policy that may affect your eligibility and savings.

This HTML structure provides a comprehensive overview of the federal tax rebate for hybrid vehicles while addressing potential questions that readers may have. The article maintains a logical flow from introduction to conclusion and effectively engages readers throughout.

Download Federal Tax Rebate For Hybrid Vehicles