Taxes are a crucial aspect of the financial landscape for individuals and businesses alike. While paying taxes is an obligation, tax rebates can provide relief and even lead to significant savings for taxpayers. Understanding tax rebates, determining your eligibility, and learning how to claim them can empower you to make informed financial decisions. This article aims to demystify tax rebates and provide a comprehensive guide on how to navigate them.

What is a Tax Rebate?

A tax rebate is a refund issued by the government to taxpayers when they have paid more taxes than they owe. This can occur due to various reasons, including tax credits, deductions, or withholdings that exceed tax liability. Tax rebates are designed to incentivize certain behaviors, such as education, homeownership, or low-income support.

Types of Tax Rebates

Tax rebates come in various forms, including:

- Refundable Credits: These reduce the amount of tax owed, and if they exceed your tax liability, the excess is refunded. Examples include the Earned Income Tax Credit (EITC) and the Child Tax Credit.

- Non-refundable Credits: These can reduce your tax liability to zero, but any remaining amount is not refunded. Examples include education credits.

- Tax Deductions: Deductions lower your taxable income, which can subsequently reduce your overall tax liability, indirectly resulting in a rebate.

- Direct Payments: Some governments distribute direct payments to eligible individuals, often in response to economic crises or specific policies, which can be seen as a form of rebate.

Eligibility for Tax Rebates

Eligibility for tax rebates varies based on the specific rebate program and personal circumstances. Factors that commonly influence eligibility include:

- Income Level: Many tax rebates have income limits. For instance, the EITC is targeted at low-to-moderate-income earners.

- Filing Status: Your marital status and whether you claim dependents can affect your eligibility for various rebates.

- Residency Requirements: Some rebates are only available to residents of specific states or provinces.

- Age: Certain rebates, such as education credits, have age restrictions for eligibility.

- Specific Situations: Other factors such as having a child, being a full-time student, or meeting specific health criteria might also affect eligibility.

How to Claim Your Tax Rebate

Claiming a tax rebate involves a series of steps that require careful attention to detail. Here’s a simplified guide to help you through the process:

- Understand the Requirements: Research the eligibility criteria for the tax rebate you are interested in. Gather relevant documents like income statements, proof of residency, and any other necessary information.

- Complete the Correct Tax Forms: Depending on your location and the specific rebate, you may need to complete certain tax forms. Ensure that you carefully fill out your tax return, including any additional schedules needed for credits.

- Double-Check Your Information: Errors or incomplete information can delay the rebate process. Review your forms thoroughly to ensure everything is accurate.

- Submit Your Tax Return: File your tax return, whether electronically or by mail, by the applicable deadline.

- Track Your Refund: After submission, keep track of your refund status using the online tools offered by tax authorities if available.

Conclusion

Understanding tax rebates can open new opportunities for financial relief. By familiarizing yourself with the types of rebates, eligibility criteria, and claiming processes, you can ensure that you are not leaving any money on the table. Always stay updated on changes in tax legislation and seek professional advice when necessary. Tax rebates can significantly impact your financial situation, so taking advantage of them is well worth the effort.

FAQs

1. What is the difference between a tax deduction and a tax rebate?

A tax deduction reduces your taxable income, while a tax rebate is a refund issued when you pay more tax than you owe, often through credits or adjustments.

2. How can I find out what tax rebates I am eligible for?

You can check with tax authorities, consult reputable tax software, or meet with a tax professional who can guide you based on your specific circumstances.

3. Are tax rebates tax-free?

Yes, tax rebates are generally not considered taxable income, as they are refunds of your own overpaid taxes.

4. When will I receive my tax rebate?

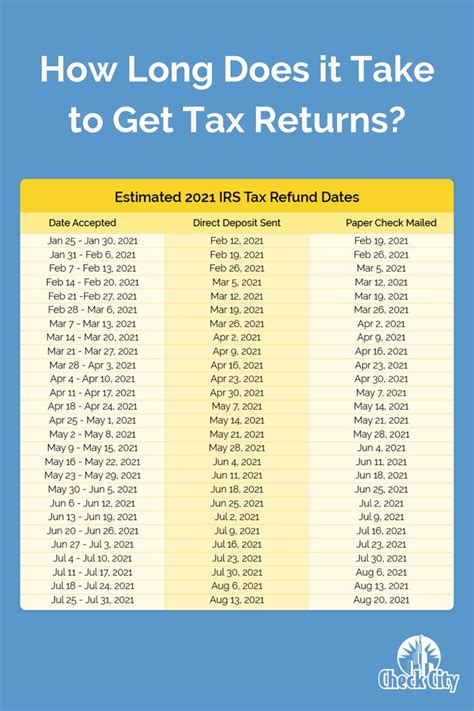

Timelines can vary based on how you filed your taxes (e-file or paper), as well as the specific tax authority’s processing times. Typically, rebates can take anywhere from a few weeks to several months to process.

5. What if I miss the deadline to claim my rebate?

If you miss the deadline for a rebate, you may lose your eligibility. However, you may still be able to file an amended return if there are other tax credits or deductions you can claim.

This HTML format is suitable for a WordPress post, containing all the necessary sections and adhering to your request regarding content structure.

Download Will I Receive A Tax Rebate