Anchor Rebate NJ: Latest Updates and What You Need to Know

The Anchor Rebate program in New Jersey has recently gained renewed attention, particularly in light of the latest updates and legislative changes. For homeowners and renters alike, understanding this program is crucial for ensuring you receive the benefits and rebates you may be entitled to. Below, we provide a comprehensive overview of the Anchor Rebate program, recent changes, eligibility criteria, and guidance on how to apply.

What is the Anchor Rebate Program?

The Anchor Rebate program was introduced to provide property tax relief to homeowners and renters in New Jersey. Aimed at reducing the financial burden associated with property taxes, the program has been an essential component of the overall tax relief strategy in the state. By providing rebates based on income levels and the amount of property tax paid, the Anchor Rebate program aims to promote affordability and stability for New Jersey residents.

Recent Updates to the Program

In the most recent legislative session, several important changes were enacted to improve the Anchor Rebate program:

- Increased Funding: The state has allocated additional funds to expand the program, allowing for larger rebates that will benefit more residents.

- Expanded Eligibility: Eligibility requirements have been revised to include a larger demographic, ensuring that more low and middle-income families can take advantage of the rebates.

- Streamlined Application Process: New measures have been put in place to simplify the application process, making it easier for residents to submit their claims and receive their rebates in a timely manner.

Eligibility Criteria

To qualify for the Anchor Rebate, applicants must meet specific criteria:

- Residency: Applicants must be residents of New Jersey.

- Income Limits: Your total income must fall below a certain threshold, which is determined annually.

- Property Ownership or Rent: You must either own property or reside as a tenant in a rental property.

It’s crucial for potential applicants to check the latest guidelines, as these requirements can change annually.

How to Apply for the Anchor Rebate

The application process for the Anchor Rebate program has been made easier in recent years. Here are the steps you need to follow to apply:

- Gather Required Documents: This includes proof of residency, income statements, and documentation of property taxes paid.

- Visit the NJ Division of Taxation Website: This is where you can find the online application form and additional resources. You may also apply via mail if preferred.

- Complete the Application: Be sure to provide accurate information to avoid any delays in processing your rebate.

- Submit Your Application: Ensure that you pay attention to the submission deadline, which typically falls in the summer months.

After submission, applicants will receive confirmation of their application status, and rebates are usually issued by the end of the year.

Importance of the Anchor Rebate Program

The Anchor Rebate program plays a pivotal role in the financial well-being of many New Jersey residents. Property taxes can be a significant burden, especially for low and middle-income families. By providing direct financial relief, the program helps to ensure that New Jersey remains an affordable place to live, fostering stability in communities across the state.

Moreover, the program encourages homeownership and supports renters by allowing them to receive a portion of property tax relief that would typically benefit homeowners. This inclusiveness is essential for bolstering the overall economy and improving the quality of life for residents until more comprehensive tax reforms can be considered.

Conclusion

The Anchor Rebate program in New Jersey represents a critical resource for those struggling with the state’s high property taxes. With the latest updates, including increased funding and expanded eligibility, now is the time for residents to take full advantage of this essential program. By understanding the eligibility criteria and applying correctly, you can potentially save hundreds or even thousands of dollars on your property tax bill. Stay informed and make sure your application is submitted on time to benefit from this valuable program.

FAQs

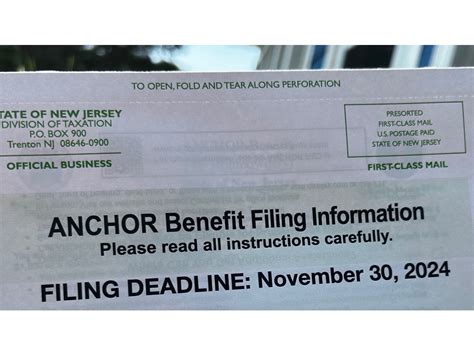

1. What is the deadline for applying for the Anchor Rebate?

The application deadline typically falls in the summer months each year, so it’s essential to check the NJ Division of Taxation website for the specific date.

2. How much can I expect to receive from the Anchor Rebate?

The amount of the rebate varies based on your property tax payments and total income, but it can range from a few hundred to over a thousand dollars.

3. Can renters apply for the Anchor Rebate?

Yes, renters can apply for the Anchor Rebate as long as they meet the eligibility criteria. The rebate is based on the amount of property taxes their landlord pays.

4. How can I check the status of my application?

You can check the status of your application by visiting the NJ Division of Taxation website or by contacting their customer service directly.

5. What if my application is denied?

If your application is denied, you will receive a notification explaining the reason. You may appeal the decision or correct any issues and reapply during the next application period.

This HTML format provides a structured and detailed article while ensuring clarity and accessibility for readers.

Download Anchor Rebate Nj Status