Unlock Your Wealth: How to Find and Maximize Your Tax Rebate

Tax season can be a daunting time for many individuals, but it also presents a prime opportunity to unlock hidden wealth through understanding and maximizing your tax rebate. Your tax rebate is essentially your money being returned to you, typically due to overpayments or qualifying deductions. This article will provide you with the insights you need to navigate the maze of tax rebates, ensuring that you get every dollar you deserve.

Understanding Tax Rebates

At its core, a tax rebate is a refund of excess taxes paid to the government. Whether it’s through income tax credits, deductions, or simply overpayment, many eligible taxpayers leave money on the table each year due to a lack of knowledge about these rebates. Understanding how taxes work and the various incentives available is the first step towards maximizing your rebate.

Step 1: Know What You’re Eligible For

Eligibility for tax rebates varies based on several factors including income level, filing status, and life circumstances. Here are some common rebates you might qualify for:

- Earned Income Tax Credit (EITC): A refundable tax credit for low to moderate-income working individuals and families, particularly those with children.

- Child Tax Credit: A credit for taxpayers with dependent children under a certain age, aimed at reducing tax liability.

- American Opportunity Credit: For eligible students, this credit covers qualified education expenses for the first four years of higher education.

- Residential Energy Credits: Homeowners who make energy-efficient improvements may qualify for rebates that offset the costs of these upgrades.

Step 2: Gather Your Documentation

To maximize your tax rebate, you must gather all the necessary documentation. This documentation will vary based on your source of income and qualification for deductions or credits. Important documents to collect include:

- W-2 Forms from employers

- 1099 Forms for other income (freelance work, investment income)

- Records of deductible expenses (e.g., medical expenses, education expenses)

- Receipts for energy-efficient home improvements

- Proof of qualifying children (birth certificates, Social Security numbers)

Step 3: Choose the Right Filing Status

Your filing status plays a significant role in the calculation of your tax rebate. There are five main filing statuses:

- Single

- Married Filing Jointly

- Married Filing Separately

- Head of Household

- Qualifying Widow(er)

Choosing the status that best fits your situation can dramatically impact your eligibility for certain credits and ultimately increase your rebate.

Step 4: Take Advantage of Deductions

Tax deductions directly reduce your taxable income, which in turn can increase your rebate. There are two types of deductions: standard and itemized. The standard deduction is a fixed amount you can claim based on your filing status. Itemized deductions require you to enumerate qualified expenses, but they may lead to a larger benefit if your total exceeds the standard deduction.

Common Deductions Include:

- Mortgage interest

- State and local taxes

- Charitable donations

- Medical expenses exceeding a certain percentage of income

Step 5: Use Tax Preparation Software

Tax preparation software can be a fantastic resource for maximizing your tax rebate. These programs often guide users through the process, pointing out potential deductions and credits that may have been overlooked. Some widely used options include TurboTax, H&R Block, and TaxAct. Many of these platforms allow users to file for free if their income is below a certain threshold.

Step 6: Consult with a Tax Professional

If your financial situation is complex or you feel uncertain about handling your taxes, it might be wise to engage a tax professional. They can provide insights and advice tailored to your personal situation, ensuring that you do not miss out on eligible rebates. Additionally, they can keep you informed about changes to tax laws that may impact your rebate opportunities in the future.

Conclusion

Unlocking your wealth through tax rebates requires a combination of knowledge, organization, and strategic planning. By understanding your eligibility, gathering the right documents, choosing the right filing status, and taking advantage of deductions, you can maximize your tax rebate. Whether you choose to navigate the tax landscape on your own or seek professional assistance, taking these steps will help ensure that you keep more of your hard-earned money in your pocket.

FAQs

1. What is a tax rebate?

A tax rebate is a refund given to taxpayers when they have paid more taxes than they owe. It typically occurs when tax credits, deductions, or overpayments apply.

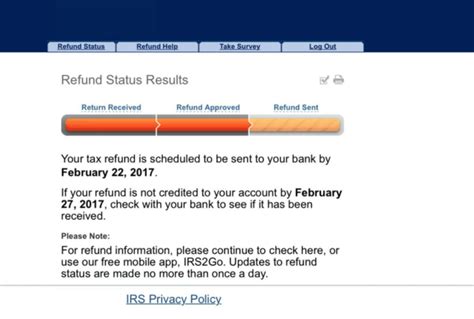

2. How can I check my tax rebate status?

You can check your tax rebate status online through the IRS website by providing your personal information, including your Social Security number and filing status.

3. Can I claim my rebate on my state taxes as well?

State tax rebates may differ from federal rebates. You should check your state’s tax regulations to see what applies to you.

4. Are there common mistakes to avoid when filing for a tax rebate?

Yes, common mistakes include failing to include all income, neglecting to claim eligible credits or deductions, and filing with the wrong status. Always double-check your information for accuracy.

5. What happens if I miss the deadline to file for my tax rebate?

If you miss the deadline, you may miss out on potential rebates. However, you can still file your tax return late, but you may face penalties and interest for unpaid taxes.

Download Find My Tax Rebate