Understanding Tax Rebates: Are You Eligible for a Windfall?

Tax rebates are often misunderstood, yet they can represent a significant financial boost for eligible taxpayers. In many cases, these rebates are designed to ease the financial burden on individuals and families, particularly during challenging economic times. But what exactly is a tax rebate, and how do you know if you’re eligible for one? This article will provide a comprehensive overview to help you navigate the often-complex world of tax rebates.

What is a Tax Rebate?

A tax rebate is a refund on taxes when the tax liability is less than the total amount of tax paid. Essentially, if you’ve paid more in taxes than you owe, you could be entitled to a rebate. Rebates can come in various forms, such as cash payments, credits toward future tax liabilities, or adjusted withholding amounts.

Different Types of Tax Rebates

Tax rebates can vary based on several factors, including your income level, filing status, and the specific tax year. Here are some common types of rebates:

- Child Tax Credit: This provides families with a credit for each qualifying child, which could lead to a significant rebate.

- Earned Income Tax Credit (EITC): A benefit primarily aimed at low to moderate-income working individuals and families.

- Education Credits: Tax credits that help offset the costs of higher education.

- State-Specific Rebates: Some states offer rebates based on local tax codes and economic conditions.

Who is Eligible for a Tax Rebate?

Eligibility for a tax rebate can depend on numerous factors. Here are the key elements that can determine your eligibility:

- Income Level: Many tax rebates have income thresholds. Higher earners may not qualify for certain rebates.

- Filing Status: Different filing statuses (single, married filing jointly, etc.) can impact your eligibility and the amount of the rebate.

- Dependents: Claiming dependents on your tax return can also influence the rebates available to you.

- Specific Tax Situations: Certain life events, such as marriage or having a child, can qualify you for additional rebates.

How to Claim Your Tax Rebate

Claiming a tax rebate typically involves filing your tax return and ensuring that you claim any eligible credits and deductions:

- Gather Necessary Documentation: Collect all relevant financial documents, such as W-2s and 1099s, as well as documentation for any credits you are claiming.

- Complete Your Tax Return: Make sure to accurately report all income and expenses.

- Claim Your Rebates: Be sure to fill out any forms related to the rebates you are claiming.

- File Your Tax Return: Submit your tax return electronically or via mail before the tax deadline.

Common Misconceptions About Tax Rebates

Many people hold misconceptions about tax rebates. Here are a few corrections to common myths:

- “Every taxpayer gets a rebate.” This is not true. Not everyone is eligible; it largely depends on income and specific tax situations.

- “Rebates are free money.” In reality, a rebate is a return of your money. Often, the taxes you have paid exceed your liability based on your filings.

- “Tax rebates will always be the same amount.” The amount can vary greatly year-over-year based on tax codes and personal financial situations.

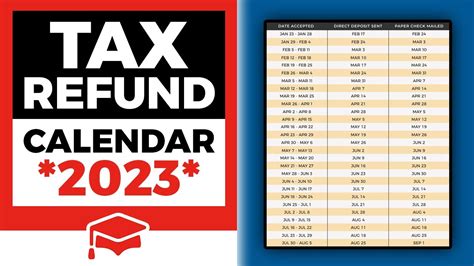

When Can You Expect to Receive Your Rebate?

The timeline for receiving your tax rebate can vary. Generally, it could take anywhere from a few weeks to several months, depending on:

- How You Filed: Electronic filings tend to be processed faster than paper returns.

- When You File: Filing earlier usually means you will receive your rebate sooner, while last-minute filers may experience delays.

- Additional Review: If your return is flagged for review, this could extend the wait time for your rebate.

Conclusion

Understanding tax rebates is crucial for maximizing your financial situation and ensuring that you take advantage of any eligible opportunities. By knowing what a tax rebate is, the different types available, eligibility requirements, and the process for claiming them, you can navigate your tax filings with confidence. Always stay updated on tax code changes and consider consulting with a tax professional if you have questions. The windfall you could receive may be bigger than you think!

FAQs

1. What is the difference between a tax rebate and a tax credit?

A tax credit directly reduces the amount of tax owed, while a rebate is a refund of excess taxes paid.

2. Can I still get a tax rebate if I owe back taxes?

It is possible, but your rebate may be applied to any outstanding tax debts.

3. How can I check the status of my tax rebate?

You can check your tax rebate status by visiting the IRS website and using their “Where’s My Refund?” tool.

4. Are tax rebates taxable?

Generally, tax rebates are not considered taxable income since they are a return of your own money.

5. Do all states offer tax rebates?

No, not all states provide tax rebates. Eligibility and availability depend on individual state laws and budgets.

Download Do I Get A Tax Rebate