Keep Warm and Save Money: Your Guide to Tax Rebates for New Furnaces

As the colder months approach, ensuring your home is warm and comfortable becomes a priority. However, replacing an old furnace can be an expensive investment. Fortunately, there are tax rebates and incentives available that can help reduce the cost of a new furnace. This article will guide you through understanding these financial benefits and how to take advantage of them.

Understanding Tax Rebates

Tax rebates are essentially a form of financial assistance provided by governments to encourage homeowners to invest in energy-efficient home improvements. These rebates can come from federal, state, or local governments and can significantly lower the overall cost of purchasing and installing a new furnace.

Benefits of Upgrading to a New Furnace

Before we dive into the specifics of tax rebates, let’s consider why upgrading your furnace is a wise choice:

- Energy Efficiency: New furnaces are designed to be energy-efficient, which means they consume less energy to produce the same amount of heat, resulting in lower utility bills.

- Improved Air Quality: Modern furnaces come equipped with advanced filtration systems, improving indoor air quality by trapping allergens and pollutants.

- Reliability: Old furnaces may require frequent repairs. Investing in a new unit can ensure reliable heating and peace of mind during the winter months.

Types of Tax Rebates

When it comes to tax rebates for new furnaces, several types are commonly available:

1. Federal Tax Credit

The federal government offers tax credits for energy-efficient appliances, including furnaces. As of the latest information, homeowners can receive a tax credit of up to 30% of the cost of a new, qualifying furnace, with a maximum credit cap. Always check the IRS guidelines to confirm eligibility and specific requirements.

2. State and Local Rebates

Many states and local municipalities offer their own rebates for energy-efficient home improvements. These can vary widely in terms of the amount and eligibility requirements. A quick search on your state government’s website can provide you with valuable information about available rebates.

3. Utility Company Incentives

Utility companies often provide incentives for customers who opt for energy-efficient appliances. These incentives can include rebates, discounts, or financing options, making it easier for homeowners to invest in a new furnace.

Steps to Take Advantage of Tax Rebates

To ensure you are making the most of available tax rebates, follow these steps:

- Research Eligibility: Before purchasing a new furnace, research the types of rebates available at the federal, state, and local levels.

- Select Energy-Efficient Models: Look for furnaces that meet energy efficiency standards. Products with the ENERGY STAR label are often eligible for the maximum rebates.

- Keep Documentation: Save all receipts, installation paperwork, and product certifications to ensure you can apply for your rebates without any issues.

- Consult a Tax Professional: Consider consulting with a tax professional who can help you navigate the application process and ensure you maximize your savings.

Available Furnace Options

When considering a new furnace, several options are available:

- Gas Furnaces: These are common in many households and tend to be more efficient than electric models.

- Electric Furnaces: While generally easier to install, electric furnaces may lead to higher monthly energy costs depending on your local utility rates.

- Heat Pumps: These are versatile systems that can provide both heating and cooling, offering year-round comfort and efficiency.

Conclusion

Investing in a new furnace is not only crucial for your home’s comfort during the winter months, but it can also lead to significant savings through various tax rebates and incentives. By understanding the types of available rebates and taking the necessary steps to qualify, you can keep your home warm while also saving money. Always stay informed about changes in rebate programs and consider working with qualified professionals to make the process as seamless as possible. With the right furnace and financial planning, you can maintain a cozy living space without breaking the bank.

FAQs

1. How do I know if my furnace qualifies for tax rebates?

Check for the ENERGY STAR label and consult with your local energy department or utility company for specific qualifying criteria.

2. Can I receive more than one rebate for my new furnace?

Yes, you may qualify for federal, state, local, and utility company rebates simultaneously, but it’s essential to review the specific terms for each.

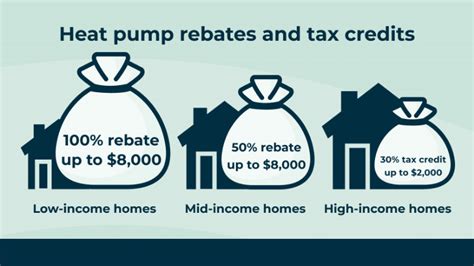

3. Are there income restrictions for receiving rebates?

Some programs may have income restrictions, while others do not. Reviewing the eligibility requirements for each rebate program is crucial.

4. Do I need to provide proof of installation for rebates?

Yes, most rebate programs will require proof of purchase and installation, such as receipts and installation documents.

5. Are these rebates available every year?

Rebate availability can vary by year and program. Always check current guidelines to ensure the rebates are still being offered.

Feel free to modify it further to suit any specific styles or formats needed!

Download Tax Rebate For New Furnace