Governor Kemp Proposes New Tax Rebates: What Georgians Need to Know

Recently, Governor Brian Kemp of Georgia announced his proposal for new tax rebates aimed at providing financial relief to residents. As Georgians continue to navigate economic challenges, this initiative highlights the state’s commitment to easing the burden on taxpayers. In this article, we will explore the key elements of the proposed tax rebates, their implications for Georgia residents, and what you need to know to take advantage of these financial benefits.

Overview of the Proposed Tax Rebates

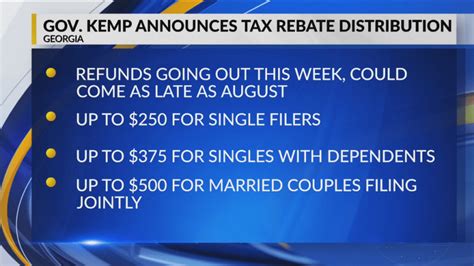

The proposed tax rebates are designed to provide direct financial relief to Georgians. Governor Kemp’s announcement outlines a plan to issue one-time rebates based on each taxpayer’s filing status. According to his proposal, single filers could expect to receive a rebate of up to $250, while joint filers may receive up to $500. This structured approach aims to offer equitable relief across various income levels.

Who Qualifies for the Rebates?

To qualify for the tax rebates, taxpayers must meet certain criteria, which generally include:

- Being a resident of Georgia.

- Having filed a state income tax return for the applicable year.

- Meeting income thresholds established by the Georgia Department of Revenue.

It is essential for residents to ensure that they have completed their tax filings accurately to benefit from this initiative.

How Will the Rebates Be Distributed?

Governor Kemp’s proposal indicates that the rebates will be issued following the state’s tax filing deadline. Eligible taxpayers can expect to receive their rebates through either direct deposit or paper checks, depending on how they filed their taxes. The state aims to process these rebates as swiftly as possible to provide timely assistance to those in need.

The Economic Impact of Tax Rebates

The implementation of these tax rebates is expected to have a positive impact on the state’s economy. By putting money back into the pockets of residents, the rebates will stimulate local spending, benefiting businesses across Georgia. Moreover, the initiative is designed to reinforce the state’s recovery efforts in the wake of economic disruptions caused by the pandemic and other factors.

Comparison with Previous Initiatives

This proposal isn’t the first time Georgia has seen tax rebates. In previous years, Kemp has pushed for similar measures. By comparing past initiatives, we can gauge the effectiveness of these efforts. For instance, in 2022, previous rebates provided a temporary boost to consumer spending, which helped local economies recover faster. The current proposal builds on this success, aiming to further support Georgians during challenging financial times.

Important Dates to Keep in Mind

As with any financial initiative, it’s crucial to be aware of key dates associated with the tax rebates. Here are some important dates to note:

- Tax Filing Deadline: Ensure that your state income tax return is filed by April 15th.

- Rebate Issuance: Rebates are expected to be distributed shortly after the tax filing deadline.

Residents should keep an eye on announcements from the Georgia Department of Revenue for any updates regarding these dates.

How to Prepare for the Tax Rebates

To ensure a smooth rebate process, Georgians are advised to:

- File their state taxes promptly and accurately.

- Double-check that all required documents are submitted.

- Consider opting for direct deposit to receive rebates more quickly.

These steps will aid in ensuring eligibility and prompt rebate distribution.

Conclusion

Governor Kemp’s proposal for new tax rebates represents a significant effort to support Georgians during times of financial strain. By offering direct financial relief, the initiative aims to bolster local economies and improve the financial well-being of residents. Staying informed about eligibility, filing requirements, and distribution methods will be crucial for Georgians to take full advantage of this opportunity. As the proposal moves forward, the impact of these rebates will likely be keenly felt across the state.

FAQs

1. When will the tax rebates be issued?

Tax rebates are expected to be issued shortly after the state income tax filing deadline. Residents should keep an eye on updates from the Georgia Department of Revenue.

2. How do I know if I’m eligible for the rebate?

Eligibility generally requires being a Georgia resident, having filed a state income tax return, and meeting any established income thresholds. Be sure to check the specifics outlined by the Georgia Department of Revenue.

3. Will I receive the rebate as a direct deposit or a check?

Rebates will be distributed based on how you filed your taxes—either as a direct deposit or a paper check.

4. What should I do if I haven’t filed my taxes yet?

If you haven’t filed your taxes, ensure that you complete your state income tax return by the deadline to qualify for the rebate.

5. How can I stay updated on the tax rebate process?

For the latest information, regularly check the Georgia Department of Revenue’s official website and follow news updates regarding the tax rebates.

Download Georgia Tax Rebate Kemp