Maximizing Your Savings: Understanding New Jersey’s Homestead Rebate Program

New Jersey homeowners are always looking for ways to save on property taxes, and one of the most beneficial programs available is the New Jersey Homestead Rebate Program. This initiative is designed to provide property tax relief to eligible homeowners, making it essential to understand how it works and how to successfully navigate the application process. In this article, we will cover the fundamentals of the Homestead Rebate Program, eligibility requirements, the application process, and tips for maximizing your savings.

What is the New Jersey Homestead Rebate Program?

The New Jersey Homestead Rebate Program offers rebates on property taxes for homeowners based on their income and property tax payments. This program has been instrumental in providing financial relief to many residents, especially those with lower to moderate incomes. It works by rebate checks sent directly to eligible homeowners, which can make a significant impact on overall property expenses.

Eligibility Requirements

To qualify for the New Jersey Homestead Rebate, homeowners must meet several criteria:

- Ownership: You must own and occupy your home as your principal residence.

- Income Limit: There are income limits that determine eligibility, which can change annually. As of recent legislation, the income limit for most homeowners is set at $150,000.

- Property Taxes Paid: The rebate amount is calculated based on property taxes that you have paid during the tax year.

- Age and Disability Considerations: Additional rebates are available for senior citizens and disabled persons, offering an extra level of financial assistance.

Understanding the Rebate Calculation

Rebate amounts vary based on your income and the property taxes you have paid. Generally, lower-income homeowners receive higher percentages of their property taxes back as a rebate. For example, a homeowner with an income of $75,000 might receive a higher rebate than someone with an income of $150,000 even if both paid the same amount in property taxes.

In most cases, the program uses your property tax bill from the previous year to calculate the amount you are eligible to receive. It’s important to keep accurate records of your property tax payments as proof of the taxes you’ve paid.

The Application Process

Applying for the New Jersey Homestead Rebate is straightforward, though it involves several steps:

- Gather Documentation: Collect documents related to your income, property tax payments, and any necessary identification.

- Online Application: The New Jersey Division of Taxation allows homeowners to apply online. You need to create an account on their website or access your existing account.

- Submit Application: Fill out all required fields accurately, submit any necessary documentation, and ensure that you file before the deadline for that tax year.

- Keep Track: After submission, monitor the status of your application through the online portal. You should receive updates regarding your rebate status.

Maximizing Your Savings

To truly maximize your savings through the Homestead Rebate Program, consider these tips:

- Be Aware of Deadlines: Application deadlines can vary, and missing them could mean you lose out on your potential rebate. Make sure to check the official schedule regularly.

- Review Your Property Tax Bill: Ensure there are no discrepancies with your property tax bill. If you notice inconsistencies, contact your local tax assessor for clarification.

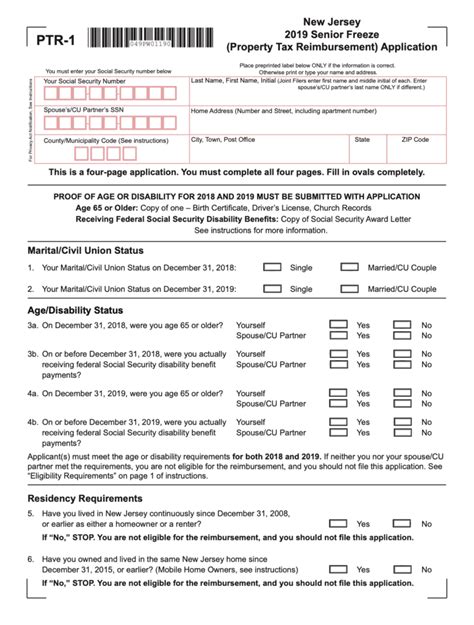

- Explore Additional Programs: In addition to the Homestead Rebate, New Jersey also offers other property tax relief programs, such as the Property Tax Reimbursement Program (Freeze Program), that may benefit you.

- Stay Informed: Changes in eligibility criteria or rebate amounts may occur yearly. Subscribe to newsletters or follow official state announcements to stay updated.

- Seek Professional Assistance: If you’re uncertain about the application process or rebate calculations, consider consulting a tax professional who specializes in New Jersey property taxes.

Conclusion

Understanding the New Jersey Homestead Rebate Program can seem daunting, but it offers crucial financial relief for homeowners. By familiarizing yourself with eligibility requirements, the application process, and strategies to maximize your savings, you can ensure that you make the most of what the program has to offer. Whether you are a new homeowner or have lived in New Jersey for years, taking advantage of this rebate program can enhance your financial security and reduce the burden of property taxes.

FAQs

1. How often can I apply for the Homestead Rebate?

Homeowners can apply for the Homestead Rebate every year, as long as they meet the eligibility requirements for that tax year.

2. How is the rebate issued?

The rebate is typically issued as a check sent directly to the homeowner’s address. It may take several months after application submission to receive it.

3. What happens if my income increases after applying?

If your income increases beyond the eligibility threshold after your application, it typically does not impact your current application for that tax year. However, you must meet the income limits for future applications.

4. Are there any changes to the program due to recent legislation?

Yes, the program can be subject to changes based on state budget appropriations and legislative updates. Always check the official New Jersey Division of Taxation website for the most current information.

5. Will my rebate amount be affected if I have a mortgage on my home?

The presence of a mortgage does not affect your eligibility for the Homestead Rebate. The rebate is based on property taxes paid, regardless of whether the homeowner has a mortgage.

Download State Of Nj Homestead Rebate