Unlocking Savings: How Property Tax Rebates Can Boost Your Wallet

In an era where every penny counts, property tax rebates emerge as a powerful tool for homeowners looking to lessen their financial burden. Understanding how these rebates work and how to take advantage of them can significantly boost your financial standing. In this article, we explore the types of property tax rebates, the eligibility criteria, application processes, and the long-term benefits of leveraging these savings.

Understanding Property Tax Rebates

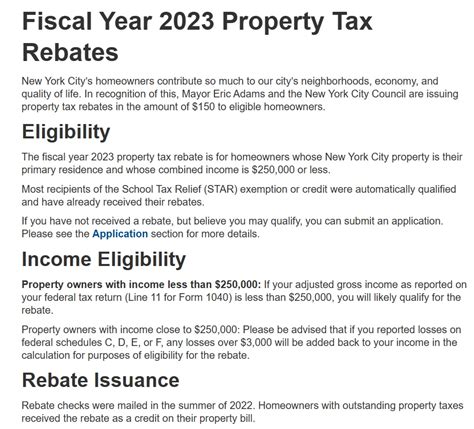

Property tax rebates are a form of financial aid provided to eligible homeowners, designed to reduce the amount of property taxes they owe to local or state governments. These rebates can vary significantly based on location, local regulations, and homeowner circumstances. Some municipalities offer them as a recognition of specific needs, such as low income, while others might provide rebates universally to stimulate local economies.

Types of Property Tax Rebates

There are various types of property tax rebates available to homeowners, which generally include:

- Homestead Rebates: These are aimed at primary residence homeowners. They often provide a percentage of the property taxes owed, reducing the overall tax burden.

- Senior Citizen Rebates: Many states offer additional benefits specifically for elderly homeowners, acknowledging their fixed incomes.

- Military and Veteran Rebates: Veterans and active military personnel may be eligible for special rebates, celebrating their service and sacrifice.

- Disability Rebates: Homeowners living with disabilities may also qualify for supplemental rebates to ease their tax obligations.

Eligibility Criteria

Eligibility for property tax rebates can vary based on several factors, including:

- Income Level: Many states have income thresholds that determine eligibility. Generally, lower-income homeowners will have a better chance of qualifying.

- Age and Status: Seniors, veterans, and disabled individuals often have unique requirements that make them eligible for specific rebates.

- Property Type: Some rebates apply only to primary residences, while others may include rental properties or second homes.

The Application Process

Applying for property tax rebates typically involves several steps:

- Research: Begin by researching the specific rebates available in your state or locality.

- Gather Documentation: Prepare the necessary documents, such as proof of income, age, or disability.

- Fill Out Application: Most areas allow you to complete your application online, but paper applications can often be submitted as well.

- Submit Your Application: Ensure that your application is submitted before the deadline.

- Follow Up: After submission, verify that your application was received and is being processed.

Long-Term Financial Benefits

Unlocking property tax rebates can yield significant benefits beyond immediate monetary relief. Here’s how:

- Increased Disposable Income: Extra savings from tax rebates can be redirected towards essential expenditures, savings, or investments.

- Promoting Financial Stability: For families or individuals living paycheck to paycheck, these rebates can help buffer against unexpected expenses.

- Enhancing Property Value: Home equity can increase as you lessen your tax burden, benefiting you when you decide to sell the property.

- Community Improvement: When more residents utilize property tax rebates, it can stimulate the local economy, benefiting shared infrastructures and services.

Challenges in Accessing Property Tax Rebates

Despite the benefits, there can be challenges when it comes to accessing property tax rebates:

- Complexity of Application: The application process may be convoluted, leading to confusion that can deter homeowners from applying.

- Awareness: Not all homeowners are aware of the rebates available to them, resulting in missed opportunities for savings.

- Changes in Policy: State or local policies regarding property tax rebates can change, necessitating homeowners to stay informed about their eligibility.

Conclusion

Property tax rebates can be an effective means to unlock significant savings for homeowners, providing much-needed relief in today’s economic climate. By thoroughly understanding the types of rebates available, how to apply, and the potential long-term benefits, homeowners can take proactive steps to enhance their financial health. With ongoing research and vigilance in monitoring property taxes and related state policies, homeowners can ensure they are maximizing their savings and effectively managing their overall financial strategy.

FAQs

What is the average amount of property tax rebates homeowners receive?

The average amount varies widely by state and local jurisdictions. Some homeowners may receive a few hundred dollars, while others may qualify for several thousand based on their unique circumstances.

How do I find out if I qualify for property tax rebates?

Start by checking your local government’s website or contacting your local tax assessor’s office. They can provide information about eligibility and available rebates in your area.

Are property tax rebates considered taxable income?

In most cases, property tax rebates are not considered taxable income. However, it is always prudent to consult a tax advisor to understand your specific situation.

When is the best time to apply for a property tax rebate?

Each state has its deadlines for applications, often coinciding with tax season. It’s best to apply as soon as you determine your eligibility to ensure you don’t miss the cut-off date.

Download Rebate On Property Tax