Unlocking Savings: How Tax Rebates Can Boost Your Energy Efficiency Upgrades

Energy efficiency upgrades not only help reduce your monthly utility bills but also promote a sustainable future. However, the initial costs of these upgrades can often be daunting. Fortunately, tax rebates are available to ease this financial burden, making it more achievable to improve your home’s energy efficiency. In this article, we’ll explore how tax rebates work, the types of energy efficiency upgrades that qualify, and how you can benefit from these incentives.

Understanding Tax Rebates

Tax rebates are incentives provided by the government to encourage homeowners to invest in energy-efficient technologies and practices. These can come in the form of credits that reduce your overall tax liability or direct rebates that give you a portion of your investment back. They are designed to make energy-efficient upgrades more financially appealing, thus promoting environmental benefits through reduced energy consumption.

Types of Energy Efficiency Upgrades

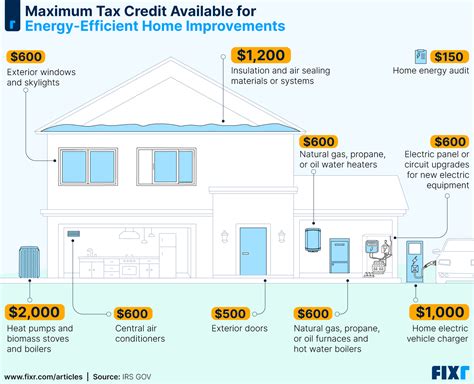

There are various energy efficiency upgrades that qualify for tax rebates. Here are a few popular choices:

- Heating and Cooling Systems: Upgrading to a high-efficiency HVAC system can significantly lower your energy bills. Look for systems that have an Energy Star certification, as these are often eligible for rebates.

- Insulation: Proper insulation helps maintain your home’s temperature, reducing the workload on your heating and cooling systems. Many local utilities offer rebates for insulating attics, walls, and basements.

- Windows and Doors: Replacing old, drafty windows and doors with energy-efficient models can lead to substantial savings. Energy Star-rated windows are often eligible for rebates.

- Appliances: Energy-efficient appliances can save you money in the long run. Check for available rebates on refrigerators, washing machines, and dishwashers that meet Energy Star guidelines.

- Solar Energy Systems: The use of solar technology has grown rapidly in recent years. Many states offer incentives for installing solar panels, which can drastically reduce your energy costs.

Maximizing Your Savings Through Tax Rebates

To make the most out of tax rebates for your energy efficiency upgrades, follow these steps:

- Research Available Rebates: Each state and locality has different incentives. Visit the Database of State Incentives for Renewables & Efficiency (DSIRE) to find what is available in your area.

- Consult with Professionals: Speak with contractors who specialize in energy-efficient systems. They often know about local rebate programs and can provide guidance on what upgrades qualify.

- Keep All Documentation: Retain receipts and relevant paperwork for all upgrades. You’ll need these when filing your taxes to claim the rebates.

Benefits of Energy Efficiency Upgrades

Investing in energy efficiency upgrades offers numerous benefits:

- Cost Savings: While initial investment costs can be high, the long-term savings on utility bills can outweigh these upfront costs.

- Increased Home Value: Energy-efficient homes are often valued higher in the real estate market. Buyers are willing to pay more for homes that promise lower energy costs.

- Environmental Impact: By reducing energy consumption, you can minimize your carbon footprint, ultimately contributing to a more sustainable planet.

Conclusion

Tax rebates can significantly enhance the financial viability of upgrading your home’s energy efficiency. By taking advantage of these incentives, not only will you save on your taxes, but you’ll also benefit from reduced energy costs and increased comfort in your home. Whether you’re looking to install a new HVAC system, replace outdated windows, or go solar, there’s a rebate opportunity waiting for you. Remember, every dollar saved is one step closer to making your home more energy efficient and contributing to a greener planet.

FAQs

1. What types of energy efficiency upgrades qualify for tax rebates?

Common upgrades include high-efficiency HVAC systems, insulation, energy-efficient windows and doors, appliances, and solar energy systems.

2. How do I find out about tax rebates available in my area?

You can visit the Database of State Incentives for Renewables & Efficiency (DSIRE) or contact your local utility provider for information on available rebates.

3. Are there any specific criteria for qualifying for tax rebates?

Generally, the upgrades must meet specific efficiency standards (like those from Energy Star), and you’ll need to provide proper documentation to claim the rebate.

4. How do I claim my tax rebate?

You will typically need to fill out specific forms during tax season, providing information about your upgrades and attaching supporting documents.

5. Are there any deadlines for claiming energy efficiency tax rebates?

Deadlines vary depending on the state and the specific rebate program. Always check with your local jurisdiction for detailed timelines.

Download Tax Rebates For Energy Efficiency