Maximize Your Savings: A Guide to the Heat Pump Tax Rebate

In recent years, the push for energy-efficient appliances has led to various tax rebates aimed at encouraging homeowners to upgrade their systems. One such incentive is the heat pump tax rebate, designed to help offset the cost of purchasing and installing heat pumps. This guide will provide you with essential knowledge about heat pump tax rebates, including eligibility requirements, how to apply, and tips to maximize your savings.

What is a Heat Pump?

A heat pump is an innovative and efficient heating and cooling system that transfers heat from one place to another. Unlike traditional heating systems that generate heat, heat pumps move heat from the outside air, ground, or water into your home, making them far more energy-efficient. They can significantly reduce energy bills and minimize your carbon footprint, which is why governments are incentivizing their adoption.

Understanding the Heat Pump Tax Rebate

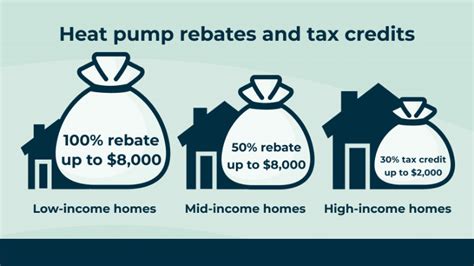

The heat pump tax rebate is a financial incentive offered by the government to encourage homeowners to install energy-efficient heat pumps. The rebate can significantly lower the upfront costs associated with purchasing and installing these systems, making it a more financially viable option for many households. The specifics of the tax rebate can vary by state or region, and it’s crucial to understand how it applies to your situation.

Eligibility Criteria for the Tax Rebate

- Income Limits: Some programs may have household income limits to qualify for the rebate.

- Property Type: Certain rebates are available only for primary residences, excluding rental properties or secondary homes.

- Type of Heat Pump: Ensure you are installing an eligible heat pump, typically those meeting Energy Star or other energy efficiency standards.

- Installation Date: Check if there are deadlines regarding the installation date to qualify for the rebate.

How to Apply for the Heat Pump Tax Rebate

Applying for the heat pump tax rebate typically involves several steps, including:

- Research Available Rebates: Begin by researching the available tax rebates in your area. Websites like the Database of State Incentives for Renewables & Efficiency (DSIRE) can be helpful.

- Choose a Qualified Installer: Ensure that your installer is certified and understands the eligibility requirements for the rebate.

- Gather Necessary Documentation: Keep all receipts and documentation related to the purchase and installation of your heat pump, as they will be required for the application process.

- Submit Your Application: Follow your local guidelines for submitting the rebate application, either online or via mail. Be sure to complete all forms accurately to avoid delays.

Maximizing Your Savings

To get the most out of your investment when opting for a heat pump, consider the following tips:

- Combine Rebates: Look for other local, state, or federal programs that may work in tandem with the federal heat pump tax rebate to enhance your savings.

- Energy Audit: Conduct an energy audit before installation to improve your home’s energy efficiency, potentially enlarging your rebate eligibility.

- Choose High-Efficiency Models: Although these models may come at a higher upfront cost, they often provide greater energy savings over time.

- Regular Maintenance: Keep your heat pump in optimal condition through regular maintenance to enhance its efficiency and longevity.

Conclusion

The heat pump tax rebate offers a fantastic opportunity for homeowners to invest in energy-efficient heating and cooling systems. By understanding the eligibility criteria and application process, as well as maximizing your savings through strategic choices and maintenance, you can significantly reduce your environmental impact while also improving your home’s energy efficiency. Now is the perfect time to consider switching to a heat pump, not just for the financial incentives but also for the long-term benefits to your home and the planet.

FAQs

1. What types of heat pumps are eligible for the rebate?

Typically, air-source, ground-source (geothermal), and water-source heat pumps that meet specific energy efficiency standards are eligible for the rebate.

2. How much can I save with the heat pump tax rebate?

The amount you can save varies widely depending on your location, the specific rebate programs available, and the type of heat pump you install. Rebates can range from a few hundred to several thousand dollars.

3. Can I claim the tax rebate for a heat pump installed in a rental property?

Most rebates are typically designated for primary residences. Be sure to check the specific terms for the program you are interested in.

4. Is there a deadline for applying for the heat pump tax rebate?

Yes, many programs have deadlines for applications, often correlated with the installation date. It’s crucial to verify deadlines with your local authority.

5. How do I find a qualified heat pump installer?

Research local HVAC contractors, ask for recommendations, and check certifications to ensure the installer is qualified to help with rebate eligibility.

This content is structured to provide valuable information in HTML format, suitable for a WordPress article. You can copy and paste it directly into the WordPress editor.

Download Heat Pump Tax Rebate