Everything You Need to Know About Pennsylvania’s Rent Rebate Program

The Pennsylvania Rent Rebate Program is a vital financial resource designed to assist eligible residents, particularly senior citizens and people with disabilities. This program, administered by the Pennsylvania Department of Revenue, aims to alleviate the burden of rent payments for low-income individuals by providing direct financial aid. Understanding the intricacies of the program can help beneficiaries maximize their rebates and plan their finances more effectively. Below, we delve into various aspects of Pennsylvania’s Rent Rebate Program, including eligibility requirements, application processes, and additional considerations for applicants.

What is the Rent Rebate Program?

The Rent Rebate Program was established in 1971 as part of the Property Tax and Rent Rebate Program, designed specifically to ensure that those on fixed incomes or low wages are not disproportionately affected by housing costs. The program allows eligible individuals to receive a rebate on rent paid during the previous year, providing them with additional financial support.

Eligibility Criteria

To qualify for the Rent Rebate Program in Pennsylvania, applicants must meet specific eligibility criteria:

- Age Requirement: Applicants must be at least 65 years old on or before December 31 of the rebate year.

- Disability Status: Individuals under 65 may also qualify if they are recognized as permanently disabled under Social Security regulations.

- Income Limits: The applicant’s total income must not exceed $35,000 per year for homeowners or $15,000 per year for renters, excluding certain nontaxable income sources such as Social Security, Supplemental Security Income (SSI), and others.

- Residency: Applicants must be residents of Pennsylvania for the entire year in which they are applying.

How to Apply

Applying for the Rent Rebate Program is a straightforward process. Here’s a step-by-step guide:

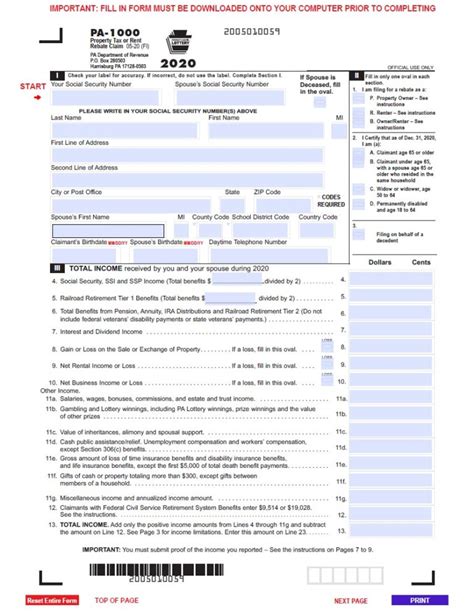

- Obtain the Application: The application form (PA-1000) can be downloaded online from the Pennsylvania Department of Revenue’s website or requested from local state representatives.

- Gather Supporting Documents: Prepare necessary documentation, including proof of income, copies of rental agreements, and any other relevant financial information.

- Complete the Application: Fill out the application accurately and ensure all necessary fields are completed, including details about income and rent paid in the prior year.

- Submit the Application: Applications can be submitted via mail to the address provided on the form. Be sure to keep a copy for your records.

- Application Deadline: The deadline for submitting an application is typically June 30 of the year after the rent was paid.

How Much Can You Expect?

The amount of the rebate varies based on the total rent paid and the individual’s income. Generally, the rebate can range from a minimum of $650 to a maximum of $975, depending on eligibility criteria:

- Rent Paid: The maximum rebate is awarded to individuals who paid $650 or more in rent in the year for which they are applying.

- Income:** The rebate amounts decrease as income increases, so those with the lowest incomes receive the highest rebates.

Special Considerations

There are several essential factors to keep in mind when applying for the Rent Rebate Program:

- Multiple Applications: If you live with roommates or family members, only one application for the full rebate can be submitted for the household. Dividing the rent among multiple applicants will not yield additional rebates.

- Retroactive Claims: Applicants may request rebates for previous years (up to three years back) if they did not apply for those years initially. Forms for retroactive applications are also available through the Pennsylvania Department of Revenue.

- Assistance and Resources: Beneficiaries can seek help through local government offices or non-profit organizations to assist with completing the application.

Conclusion

The Pennsylvania Rent Rebate Program offers crucial financial assistance to eligible residents, helping to cushion the impact of high rental costs. By understanding the eligibility criteria, application process, and potential rebates, beneficiaries can tap into this valuable resource confidently. It’s essential to pay attention to deadlines and ensure the accuracy of the application to maximize the benefits. For anyone who qualifies, participating in the Rent Rebate Program can significantly ease financial burdens and improve overall quality of life.

FAQs

1. Can I apply for the Rent Rebate Program if I am a tenant living with others?

Yes, but only one application can be submitted per household for the full rebate. Roommates or family members must determine who will submit the application.

2. What types of income are excluded from the income limit?

Some nontaxable income sources, such as Social Security benefits, Supplemental Security Income (SSI), and certain other forms of assistance, are excluded from the total income calculation.

3. When can I expect to receive my rebate?

Rebates are typically processed and sent out within a few weeks to a few months after the application deadline, depending on the volume of applications received.

4. What should I do if I missed the application deadline?

You may still apply for retroactive rebates for previous years within a three-year timeframe. Seek guidance from your local state’s revenue office for assistance.

5. Is there assistance available for completing the Rent Rebate application?

Yes, many local government offices and non-profit organizations offer assistance for completing the application process. Reach out to your local resources for help.

Feel free to customize any aspect of the article to better fit your blog’s style and target audience!

Download Pa Rent Rebate Questions