Unlocking Savings: How the New York State Star Rebate Can Benefit Homeowners

Homeownership comes with many responsibilities, not least of which are property taxes. For New York homeowners, the costs associated with property ownership can be a significant financial burden. However, there is a light at the end of the tunnel: the New York State School Tax Relief (STAR) program. This initiative provides direct savings to eligible homeowners, helping them ease the financial strain of school taxes. In this article, we’ll explore how the STAR program works, the benefits it offers, and how you can take advantage of it to unlock savings.

What Is the STAR Program?

The STAR program was created to provide property tax relief to New York homeowners, particularly those with low to moderate incomes. It has two main components: the Basic STAR and the Enhanced STAR. The Basic STAR offers homeowners a partial exemption from school property taxes, while the Enhanced STAR provides a larger exemption for seniors aged 65 and older who meet certain income guidelines.

Eligibility Criteria

To qualify for Basic STAR, homeowners must meet the following criteria:

- Must own a one, two, or three-family home, or a condominium or cooperative unit.

- Must occupy the home as their primary residence.

- Must not exceed a specific income limit, which is currently set at $500,000.

For Enhanced STAR eligibility, the following requirements must be met:

- Homeowners must be 65 years of age or older.

- Must meet the income limit, which is determined annually by the state.

- Must also satisfy the Basic STAR criteria.

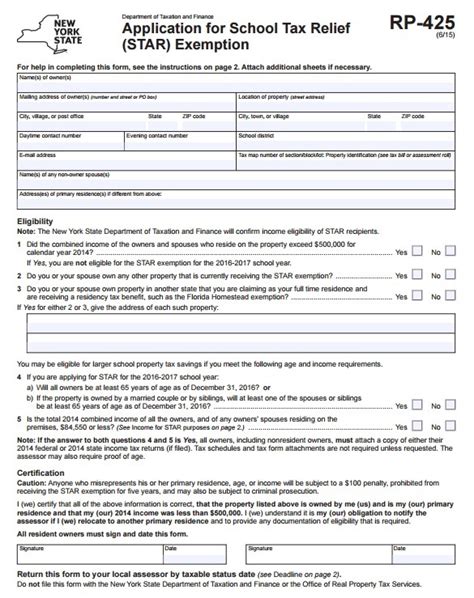

How to Apply for the STAR Program

Applying for the STAR program is a straightforward process. Homeowners can apply through their local assessors’ office. The initial application for Basic STAR usually involves completing a simple form and providing information about your property and income. For Enhanced STAR, additional documentation related to age and income will be required.

It is essential to check local deadlines and additional requirements, as these can vary by county. Once your application is approved, the STAR exemption will appear on your property tax bill, directly reducing the amount you owe.

The Financial Benefits of the STAR Program

The STAR program provides significant financial benefits for homeowners. Here are some examples:

- Basic STAR: Homeowners can save up to $1,000 annually on their school property taxes.

- Enhanced STAR: Seniors may save over $1,500 per year, depending on their income level and the assessed value of their homes.

- Long-term Savings: Over the years, the cumulative savings can amount to substantial financial relief, making the STAR program a vital resource for many families.

Impact on Homeownership

By providing relief from property tax burdens, the STAR program makes homeownership more accessible to a broader range of families. This, in turn, enhances community stability as more families are able to afford their homes and invest in their local neighborhoods. The STAR program helps lower-income families remain in their homes, promoting stronger communities and better schooling opportunities for children.

Further Considerations

While the STAR program significantly benefits homeowners, it’s important to be aware of the requirements to maintain your exemption. Homeowners need to renew their application periodically and report any changes in income that may affect their eligibility. Additionally, staying informed about any alterations to the program, such as changes in income limits or exemption amounts, is crucial for continued participation.

Conclusion

The New York State STAR program is an invaluable asset for homeowners, providing essential tax relief that can help lighten the financial load of property ownership. By understanding the eligibility criteria, application process, and financial benefits, homeowners can unlock significant savings that not only enhance their financial well-being but also contribute to the vitality of their communities. If you’re a homeowner in New York, take the time to explore how the STAR program can work for you and start reaping the benefits today.

FAQs

1. What is the difference between Basic STAR and Enhanced STAR?

Basic STAR offers a partial exemption from school property taxes for homeowners, while Enhanced STAR offers a larger exemption for seniors aged 65 and older who meet specific income criteria.

2. How do I apply for the STAR program?

You can apply for the STAR program through your local assessor’s office by filling out the required application forms and providing necessary documentation.

3. Are there income limits for the STAR program?

Yes, there are income limits set by the state. For Basic STAR, the limit is currently $500,000, while for Enhanced STAR, seniors must meet specific income criteria determined annually.

4. How much can I save through the STAR program?

Basic STAR can save homeowners up to $1,000 annually on school property taxes, while Enhanced STAR can provide savings over $1,500 for eligible seniors.

5. Do I need to renew my STAR application every year?

Yes, homeowners may need to renew their application periodically and report any changes in income that could affect their eligibility.

Download New York State Star Rebate