Unlocking Savings: What You Need to Know About the 2025 Homestead Rebate in NJ

If you’re a New Jersey homeowner, you’re likely always on the lookout for ways to save on property taxes. One of the most significant opportunities for savings is the Homestead Rebate, a program designed to alleviate the burden of rising property taxes. In this article, we’ll explore the ins and outs of the 2025 Homestead Rebate, detailing eligibility requirements, application processes, and key dates to keep in mind.

What is the Homestead Rebate?

The Homestead Rebate is a program established by the New Jersey government to provide tax relief to eligible homeowners. It allows homeowners to receive a rebate on a portion of their property taxes, thus reducing their tax burden. The rebate amount varies based on income, property taxes paid, and household composition.

Eligibility Criteria for the 2025 Homestead Rebate

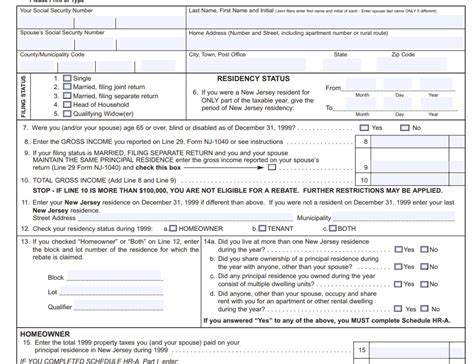

To be eligible for the 2025 Homestead Rebate, homeowners must meet the following criteria:

- Primary Residence: The property must be your primary residence in New Jersey. Vacation homes and investment properties do not qualify.

- Income Limits: Homeowners must meet specific income limits based on their filing status. For the 2025 rebate, these limits are set to align with federal poverty guidelines.

- Property Taxes Paid: Homeowners must have paid property taxes for the prior year to be eligible for the rebate.

- Age and Disability Status: Senior citizens and disabled individuals may qualify for an additional rebate or a higher amount.

The Application Process

Applying for the Homestead Rebate involves several key steps:

- Gather Required Documents: Homeowners need to provide proof of income, property tax payments, and any other documents required by the New Jersey Division of Taxation.

- Complete the Application: The application for the Homestead Rebate can be completed online or via a paper form, which can be downloaded from the New Jersey Division of Taxation website.

- Submit the Application: Make sure to submit your application before the deadline to guarantee your consideration for the rebate.

Important Dates to Remember

When dealing with the Homestead Rebate, it’s crucial to keep track of important dates:

- Application Period: The application period typically opens in early 2025 and closes by the end of June. However, specific dates can vary, so it’s essential to check the New Jersey Division of Taxation website or official announcements.

- Rebate Payments: Rebates are usually processed and distributed in the latter half of the year. Homeowners should expect to receive their rebates no later than the end of the year.

Common Questions About the 2025 Homestead Rebate

As homeowners navigate the application process, many questions often arise. Here are some frequently asked questions about the 2025 Homestead Rebate:

1. How much is the rebate?

The rebate amount varies based on several factors, including income, property taxes paid, and whether the applicant is a senior or disabled. Generally, the higher the property taxes paid, the larger the rebate.

2. Can I apply if I missed the deadline?

If you miss the deadline, unfortunately, your application will not be considered for that rebate year. However, you can prepare for the following year.

3. Is the Homestead Rebate the same as the Property Tax Exemption?

No, the Homestead Rebate is a refund based on property taxes already paid, whereas a property tax exemption can reduce the taxable value of your home.

4. What if I am a new homeowner?

New homeowners can qualify for the rebate if they meet the eligibility requirements and have paid property taxes in the prior year. Make sure to gather relevant documentation.

5. Can I appeal my rebate amount if I’m dissatisfied?

If you believe there has been an error in calculating your rebate, you can contact the New Jersey Division of Taxation to discuss your concerns and potentially appeal the decision.

Conclusion

The 2025 Homestead Rebate offers New Jersey homeowners a valuable opportunity to save on property taxes. By understanding the eligibility requirements, the application process, and important deadlines, you can maximize your potential savings. Make sure to stay informed and prepare in advance to take full advantage of this beneficial program. Every dollar saved can make a significant difference in your budget, so don’t miss out!

FAQs

If you still have questions or need further clarification regarding the Homestead Rebate, consider reaching out to your local tax office or consult the New Jersey Division of Taxation’s official website for the most accurate and up-to-date information.

Download Homestead Rebate Nj 2025