Unlock Savings: How Federal Rebates are Making Solar Panels More Affordable Than Ever

In recent years, the adoption of solar energy has surged across the United States, largely due to the combined effects of environmental awareness and technological advancements. However, one of the biggest catalysts for this rise in solar panel installation has been the federal rebates and incentives offered by the government. These initiatives are making solar power not just more popular, but also significantly more affordable for homeowners and businesses alike.

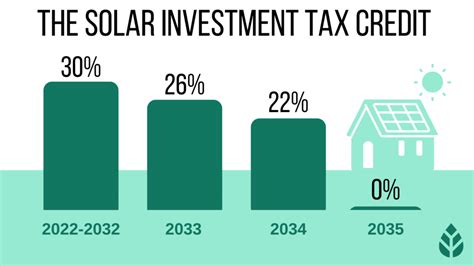

The Federal Solar Investment Tax Credit (ITC)

One of the most impactful federal incentives is the Solar Investment Tax Credit (ITC). Introduced in 2006, this program allows homeowners to deduct a significant percentage of the cost of their solar panel system from their federal taxes. As of 2023, the ITC offers a 30% tax credit, which can translate into substantial savings.

For example, if a homeowner installs a solar panel system amounting to $20,000, they can claim a tax credit of $6,000. This not only helps reduce the upfront costs but also makes financing options more palatable, creating a more accessible pathway for families considering solar energy.

State-Level Incentives and Programs

While the ITC has a sweeping effect nationwide, many states also offer their own set of rebates and incentives designed to promote solar energy adoption. These can include additional tax credits, cash rebates, and solar renewable energy certificates (SRECs).

For instance, states like California, New York, and Massachusetts have robust programs that complement the federal ITC. Homeowners can maximize their savings by combining federal and state incentives, lowering their overall investment in solar technology even further.

Financing Options Made Easy

In addition to tax credits and rebates, a variety of financing options are available that make solar power accessible to a wider audience. Solar loans, leases, and power purchase agreements (PPAs) are increasingly used to help homeowners acquire solar panels. Many financing solutions can be structured to ensure that monthly savings on energy bills can offset the loan or lease payments.

This is crucial for households that may not have significant upfront capital to invest in solar technology. Programs that allow homeowners to pay for their solar system through their energy savings create a win-win scenario. They enjoy lower energy costs while investing in renewable energy—a crucial step toward sustainability.

The Environmental and Economic Impact

Solar energy is not only a way to save money; it is also a pathway to reducing one’s carbon footprint. By utilizing renewable energy, homeowners can significantly decrease their reliance on fossil fuels, leading to cleaner air and a more sustainable environment. Furthermore, the solar industry itself contributes to economic growth by creating jobs in manufacturing, installation, and maintenance.

According to recent studies, jobs related to the solar industry have been among the fastest-growing employment sectors in the U.S. In 2022 alone, solar jobs grew by 20%, highlighting the potential for continued expansion and economic benefits driven by solar energy adoption.

Challenges and Considerations

Despite the many benefits of going solar, there are still challenges to consider. Homeowners must pay attention to local regulations, utility policies, and potential installation complications. For instance, certain regions may have restrictions on solar installations based on aesthetic concerns or zoning laws. Additionally, not all homes are suitable for solar panels due to shading from trees or other structures.

Furthermore, while federal tax incentives significantly lower costs, they may also lead to other financial complexities. It’s essential for prospective solar users to consult with tax advisors or financial specialists to understand the best avenues for leveraging these incentives.

Future Outlook

The future of solar energy in America looks exceptionally bright. The federal government has expressed a commitment to expand initiatives supporting solar energy use, aiming for a more sustainable energy future. With ongoing advancements in solar technology making systems more efficient and affordable, the industry is expected to see continued growth.

As the conversation around climate change intensifies, incentives for adopting solar technology are likely to expand. Homeowners and businesses keen to leverage these options should stay informed about new policies and incentives that will further enhance the affordability of solar panels.

Conclusion

In conclusion, federal rebates and incentives are pivotal in making solar panels more affordable than ever. The Solar Investment Tax Credit, combined with state-level incentives and various financing options, is transforming solar energy from a luxury into a viable and cost-effective solution for many Americans. By taking advantage of these programs, homeowners can save considerably while contributing to a greener future.

FAQs

1. How much can I save with federal tax credits on solar panels?

The current federal Solar Investment Tax Credit allows you to deduct 30% of the cost of your solar system from your federal taxes. This can result in substantial savings on a typical installation.

2. Do I qualify for state-level solar incentives?

Eligibility for state-level incentives varies by state. Check your state’s energy department or local solar organizations for specific programs available in your area.

3. What financing options are available for solar panels?

There are several financing options, including solar loans, leases, and power purchase agreements (PPAs), which allow homeowners to offset costs and make solar installations more financially feasible.

4. Are there any challenges to installing solar panels?

Yes, there can be challenges such as zoning laws, shading issues, and financial complexities related to tax credits. It’s advisable to consult local regulations and financial advisors before making decisions.

5. What is the long-term benefit of investing in solar energy?

Investing in solar energy leads to lower energy bills, increased property value, reduced carbon footprint, and a contribution to a sustainable environment. Additionally, the solar industry supports job creation and economic growth.

This HTML code formats the article for a WordPress post, incorporating the specified sections and a clear structure that enhances readability.

Download Federal Rebate For Solar Panels