Understanding New Jersey’s State Tax Rebate: What You Need to Know

New Jersey’s tax rebate program has been a topic of significant interest for residents and taxpayers alike. Over the years, the state has developed various rebate initiatives to provide financial relief to eligible residents. Understanding how these rebates work, who qualifies, and what to expect can go a long way in alleviating the tax burden. This article will explore the various facets of New Jersey’s state tax rebate, including eligibility, application processes, and the impact of recent legislative changes.

What is the New Jersey State Tax Rebate?

The New Jersey State Tax Rebate program is designed to provide financial assistance to residents, primarily aimed at low- to moderate-income households. The rebates help offset property taxes, which can be a significant financial strain for many residents. In essence, the state offers residents a partial refund of their property taxes through this rebate program.

Key Features of the Tax Rebate Program

Several key features characterize the New Jersey State Tax Rebate program:

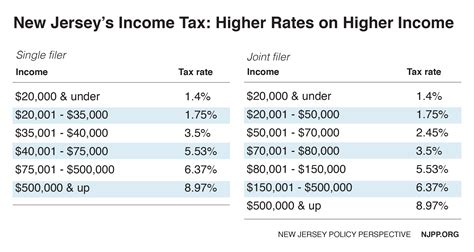

- Eligibility Criteria: Individuals and families must meet specific income thresholds to qualify for rebates. Generally, the program is geared toward those who earn below certain limits, making it essential for applicants to check the latest income requirements.

- Types of Rebates: New Jersey offers two main types of rebates: the Homestead Benefit and the Senior Freeze program. Each has different eligibility requirements and benefits.

- Application Deadlines: Timely application submission is critical. Residents must be aware of deadlines for submitting rebate applications to ensure they receive their benefits.

Eligibility Requirements

To qualify for the New Jersey State Tax Rebate, applicants must adhere to specific eligibility requirements:

- Residency: The applicant must be a resident of New Jersey and occupy the property as their principal residence.

- Income Limits: The income limits may vary annually based on various factors, including inflation. It’s crucial to check the current limits each year.

- Property Type: Only primary residences are eligible. This excludes rental properties, vacation homes, or other non-primary residences.

How to Apply for the Tax Rebate

The application process is straightforward but requires attention to detail. Here are the steps to follow:

- Gather Required Documents: Ensure you have all necessary documentation, including proof of income, property tax statements, and identification.

- Complete the Application: The application can typically be completed online through the New Jersey Division of Taxation website or by mailing a paper application.

- Submit Before the Deadline: Ensure your application is submitted before the official deadline, which is usually in the fall for the tax year.

- Track Your Application: After submission, you can check your application status online, gaining peace of mind about your rebate.

Recent Legislative Changes

In recent years, changes to tax policies have affected the state rebate program. For example, legislative actions have adjusted the income limits and rebate amounts, reflecting the state’s response to economic conditions and the needs of its residents. It is vital for residents to remain informed about these changes, which may affect eligibility and potential rebate amounts.

The Impact of the Rebate Program

The implications of the New Jersey State Tax Rebate program extend beyond mere financial relief. The rebates contribute to overall economic stability within communities, promote homeownership, and incentivize residents to remain in the state. For many, the rebate can significantly ease the burden of rising property taxes, allowing families to allocate funds toward other necessities.

Conclusion

The New Jersey State Tax Rebate program serves as a vital resource for residents aiming to alleviate their property tax burden. By understanding the eligibility requirements, application processes, and recent legislative adjustments, taxpayers can better navigate this program and maximize their benefits. Given the evolving nature of tax laws and economic conditions, staying updated is critical in ensuring one takes full advantage of the rebates available.

FAQs

1. How often can I apply for the New Jersey State Tax Rebate?

Residents can apply for the rebate annually, provided they meet the eligibility requirements for that tax year.

2. Are there any penalties for late applications?

Yes, submitting an application after the deadline may result in delayed or lost benefits, so it’s essential to apply on time.

3. Can I appeal if my rebate application is denied?

Yes, if your application is denied, you can appeal the decision by following the outlined procedures on the New Jersey Division of Taxation website.

4. What if I move out of New Jersey after receiving a rebate?

If you move out of New Jersey, you will not be eligible to apply for future rebates, and any changes to your residency should be reported to the state.

5. Where can I find more information about the state tax rebate program?

Comprehensive details can be found on the New Jersey Division of Taxation’s official website.

This HTML structure follows the WordPress format, employing headings, paragraphs, lists, and FAQs as appropriate for readability and SEO. You can copy and paste this code directly into the WordPress editor.

Download Nj State Tax Rebate